18 Mar 2024

Click here for a PDF of this newsletter

There were some pockets of strength in the market through the February reporting season – particularly with respect to the retailers which largely surprised on the upside but these were countered by resources which were broadly lower.

Overall, the ASX/S&P All Ords Accumulation Index lifted 1.2% in the month, while the ASX/S&P Small Ordinaries Accumulation Index rose 1.7%. The Cyan C3G Fund was impacted by a disappointing company outcome late in the month (ACE – discussed below) and some falls on slightly softer 1H24 results which dragged us into negative territory with a return of -3.5%. However, we have seen a reversal of this to date in March.

Although yet to fully translate into the microcap sector, signs of improvement are certainly evident, and we expect more positive sentiment to emerge in the coming months.

At the best of times reporting season is not for the faint hearted, but in the current environment, with challenges of volatility and liquidity on top of the macro environment, it proved to be a real mixed bag. The key themes we saw going into the results period played out for the most part:

- Strong organic revenue growth was difficult to find as many companies cycled against strong previous periods.

- Margins were under pressure from inflationary-based cost pressures over the past 6 to 12 months.

- Most companies have been focused on cost-control over the period and have right-sized their businesses for the current environment reducing the pain at the bottom line.

- The consumer discretionary sector provided the strongest surprise on the upside, driven by improving sales and better-than-expected earnings performances.

- This is a period of consolidation before growth resumes on lower inflation and interest rates and subsequent strengthening of sentiment.

- The small end of the market remains fundamentally and exceptionally cheap with the disparity of the pricing for large cap versus small caps at all-time highs.

There was some notable commentary from stockbroking firm Morgans with respect to reporting season worth highlighting:

Solid earnings not enough to sustain large cap valuations

- The market’s 12% rally from November to January provided resistance against rewarding larger companies at February results. The ASX 20 large-caps had a sluggish February, easing 0.4%, as heavyweights BHP, WDS, CSL, TLS and WOW fell between 5-9%. Results were mostly inline but we think a tepid growth outlook (Banks), political risk (Supermarkets) and above-average valuations (ex-Resources) contributed to these stocks’ inability to find another gear.

Small-cap resurgence takes shape

- Small/mid-cap growth and cyclicals were the bigger story in February, providing a higher proportion of results beating expectations, with a higher-than-average number positively surprising on margins and revenue. Earnings forecasts also held up well in key cyclical segments.

- Notably, cyclicals (Retailers, Industrials) represent a larger proportion of the small cap index than for large-caps. So, if the slowdown proves to be milder than anticipated and earnings hold, valuations provide plenty of support here. We expect plenty of ongoing opportunities in small-caps as the segment continues to re-base.

Click here for a PDF of this newsletter

Month in Review

Some of the key moves within the portfolio due to reporting season results were:

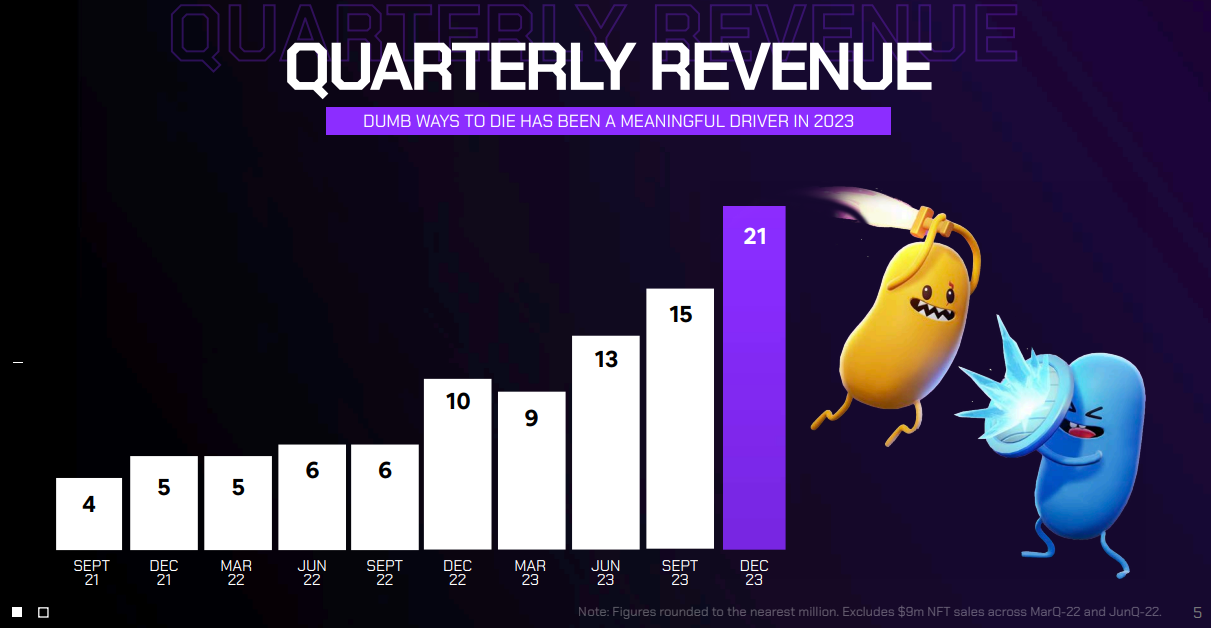

Playside Studios (PLY +23%) – The best performer in the month was gaming developer Playside Studios, after it delivered a strong interim result growing revenue 119% to $36.2m, EBITDA of $12.2m and net operating cashflow of $12.8m. All parts of the business are performing well and the company is enjoying strong investor support as it looks to execute its multi-layered growth plan over the next 24 months.

Silk Logistics (SLH -15%) – The SLH result was a typical example of the impact that challenging trading conditions can have in the short-term. This port-to-door landside logistics and supply chain services business experienced mixed conditions with slowing customer demand and subdued import container volumes resulting in slightly improved revenue and EBITDA (+8%) but a bottom-line decline due to increased depreciation and lease expenses. The medium-term growth story of SLH remains, and with the current pricing of a PE 9.6x and EV/EBITDA of 4.0x along with a fully franked yield of 4%+ we believe there is little to no value being attributed to the growth outlook for the business. We feel very comfortable remaining invested and see significant upside over the next 2 years particularly given the strong balance sheet with over $20m in cash.

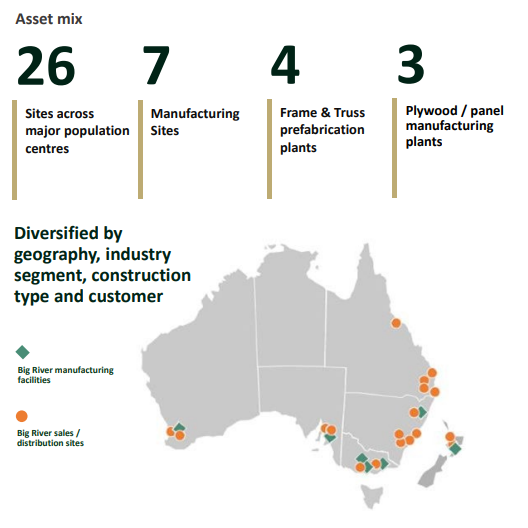

Big River Industries (BRI -11%) – This timber building products business has faced some short-term headwinds due to a softer housing and commercial real estate market and is cycling against strong results in the previous period. Nevertheless, the company reported a decent 1H24 NPAT of $7m in-line with forecasts. Like SLH, a low PE of 9.5x and dividend yield of 6% represents attractive fundamentals given the company’s extensive footprint in Australia.

Alcidion (ALC -12%) – ALC continued to face challenges in winning investor confidence as it cited delays in the award of new contracts in the NHS system in the UK. This has resulted in management reducing the cost-base of the business after a significant cash-outflow in the 1H24 period. Although frustrated, we believe the company will enjoy some new contract success over the next 6 months as it looks to secure a portion of its stated $200m tender pipeline. In March, ALC has announced a $3.4m contract extension with the Dartford and Gravesham NHS Trust.

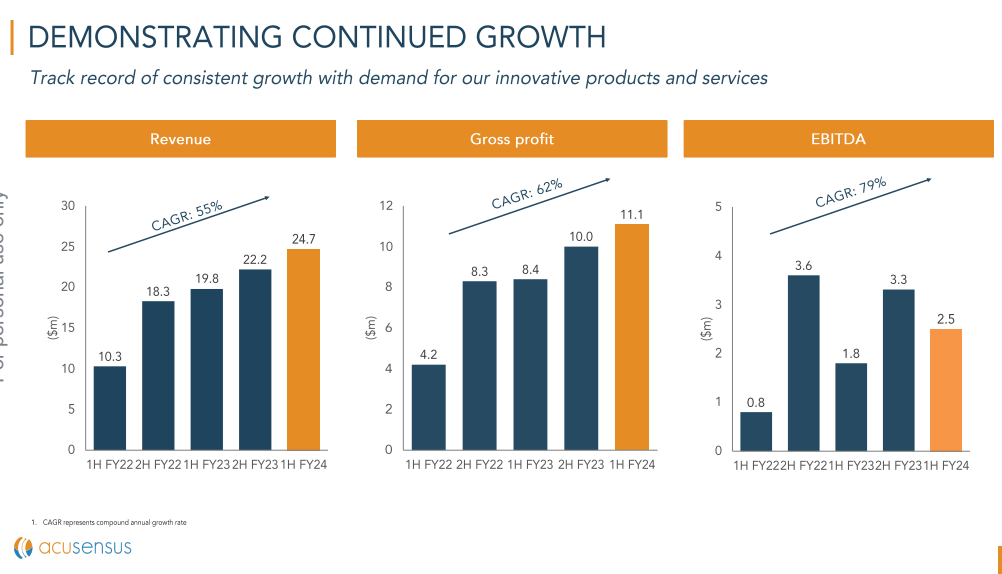

Acusensus (ACE -6%) – Acusensus designs, develops, and operates smart traffic cameras used for detection and capture of prosecutable evidence of speeding, seatbelt non-compliance and mobile phone use. The company has been highly successful in the Australian market and is expanding into the US, the UK and Europe with forecast revenues in FY24 of $50m. A strong 1H24 result was well received by the market and at one stage the stock was up 37%. Unfortunately, the company was unsuccessful in an anticipated contract in the Netherlands, taking the market by surprise and giving back all the upside towards the end of the month. Although disappointed we continue to believe ACE will be a significant success story in offshore markets and remain committed to our investment position.

Media

For all articles, videos and commentary featuring Cyan Investment Management please head to the Cyan Investment Management Linkedin page.

Outlook

Reporting season highlighted some of the anticipated short-term challenges facing many different sectors, yet FY25 forecasts have remained largely unchanged and there is a general feeling that the macro environment is improving through inflationary easing and increased potential for interest rate reductions.

There is no doubt we are seeing improved sentiment towards small cap companies, particularly those with decent liquidity and categorised as “high quality growth”. We have also seen a significant uptick in M&A activity, with names such as Adbri (ABC), Superloop (SLC), Ansarada (AND) and APM Human Services (APM) all receiving interest. We expect this activity to continue while organic growth remains hard to deliver in the short term. Balance sheet and cost bases have been positioned for the current environment, so we expect to see improvement in performance in the coming months as business transition back to growth.

We reiterate what was written in last month’s report:

In the last couple of months, we’ve started to see some real signs the tide is starting to turn. A number of our positions are trading well off their lows with 50-100%+ rises, coupled by significantly improved financial results.

We mentioned a few months ago that the catalysts to release that value included:

- A clear line of sight to the end of the rate hike cycle.

- Sustained evidence that inflation is reducing towards central bank targets.

- Data suggesting the resulting economic downturn is manageable.

- A subsequent focus back on growth companies leading to sector liquidity.

With recent announced inflation data, the first two have progressed positively and there has been some focus back on growth companies. Employment and cost-of-living data along with household debt remain of some concern for an economic downturn but a fall in interest rates should see this alleviated.

Recent company results, stock performances, and improvements in liquidity have given us a defined sense of optimism for 2024. There has also been increasing market talk of allocation to small caps being increased which should further improve sentiment and liquidity.

Dean Fergie and Graeme Carson

Cyan Investment Management

AFSL No. 453209

An investment in the Cyan C3G Fund can be made by clicking here