08 Feb 2024

There was material divergence in the performance of domestic equities as calendar 2024 kicked off. The ASX/S&P All Ords Accumulation Index lifted 1.1%, the ASX/S&P Small Industrials Accumulation Index rose 1.9% yet the ASX/S&P Emerging Companies Index experienced a significant decline of 5.5%. The Cyan C3G Fund fell between these results with a return of -2.3%.

Over the past two years in Australia emerging companies (purple) have materially underperformed both large (white) and small caps (yellow) indices as shown below. This is the longest period in which there has been such significant underperformance. History would suggest some reversion to the mean in the near term could be expected, particularly given the improved financial results we’ve been seeing from smaller companies of late.

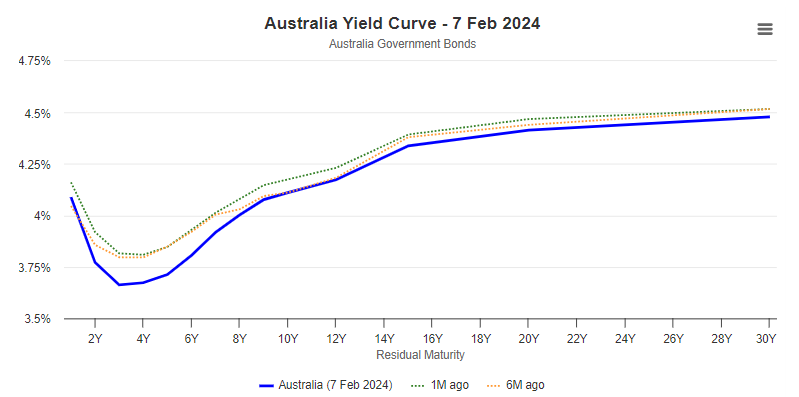

The all-important domestic inflation number for December 2023 came in at a relatively modest 4.1% year-on-year, well off the high of 7.8% a year prior and down from the 5.3% recorded in September 2023. This promoted some rate cut expectations although this was not to be, with the RBA in its February meeting deciding to keep rates unchanged at 4.35% citing:

“While recent data indicate that inflation is easing, it remains high. The Board expects that it will be some time yet before inflation is sustainably in the target range.”

Whilst this was somewhat disappointing in the short-term, the yield curve is indicating that the market is becoming increasingly optimistic of a rate cut during the course of CY24.

Click here for a PDF of this newsletter

Month in Review

Playside Studios (PLY +17%) The best performer in the month was gaming developer PLY which delivered outstanding revenues in the December quarter of $23m resulting in positive operating cash flow of $11m. The company upgraded revenue guidance (again) for FY24 to $60-65m. Given the massive quarterly sales result, this guidance could still be considered conservative. In addition, PLY’s publishing division announced in early February that it had acquired the licence for the upcoming MOUSE game, a retro game based on the now off-patent Mickey Mouse brand which has already received a strong following on gaming platforms and helped send the stock higher still in February.

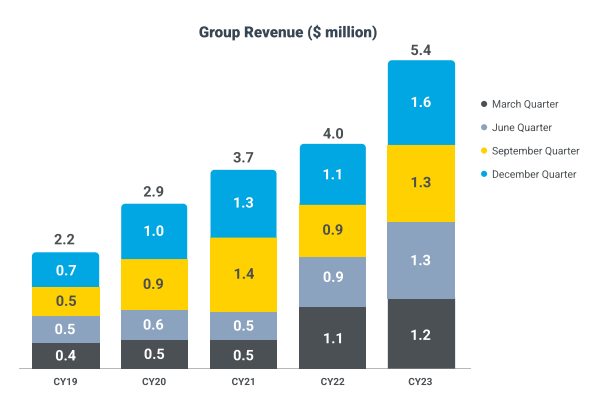

Zoom2u (Z2U +9%) This delivery platform and software provider generated record revenue in the December quarter and a material jump in revenues in CY23 (+35%), a credible result given the less than buoyant retail economy. Pleasingly their software platform Locate2u is experiencing consistent monthly increases in new clients and cash receipts and we expect further contracts as the year progresses. Costs have been well controlled with the company posting a milestone positive underlying EBITDA in the December quarter.

Touch Ventures (TVL +17%) As at December 2023 TVL held ~$60m in cash (8.5cps) plus an additional $50m (6.9c) in unlisted assets, versus a closing market price of 8.2c , a 47% discount to its net asset value. The interest in the stock this month appears to have been sparked by the purchase of almost 20% of the stock by Sydney based Gannet Capital. Despite the recent price rise there is clearly plenty of upside potential in the current market valuation.

Alcidion (ALC -24%) ALC detracted the most from the Fund’s performance in the month as investors impatiently waited for the awarding of new healthcare contracts in the UK. The first half of the calendar year is typically the strongest for ALC with the company confirming $35m+ in contracted revenue in FY24 and total contracted revenue of $125m. With net cash of $8m, a current market capitalisation of $70m and an expected stronger half year ahead, the price action of this established healthcare company appears to have been overly pessimistic in recent months.

Stocks contributing negatively to the performance of the Fund included Quickstep (QHL -17%), Entyr (ETR -28% after rising 200% in December) and Swift Networks (SW1 – 13%). On the positive side of the ledger was school e-book company Readcloud (RCL +17%) and recent fund addition, smart traffic camera operator and manufacturer Acusensus (ACE +10%).

Media

During the month on Ausbiz we highlighted the step-change Vinyl Group (ASX:VNL) has been making in the local music industry. Backed by Wisetech (WTC) founder Richard White, VNL has recently purchased Brag Media, publisher of titles such as Rolling Stone and Billboard. Combined with its existing music data business (Jaxsta), social networking company (Vampr) and retail site (vinyl.com) the company expects to generate almost $10m in revenues in CY24.

For all articles, videos and commentary featuring Cyan Investment Management please head to the Cyan Investment Management Linkedin page.

Outlook

As mentioned at the start of this newsletter the smaller end of the market has now materially underperformed for more than 2 years and this is being manifested in some extreme value at the micro end as evidenced by several companies trading below their cash backing.

In the last couple of months, we’ve started to see some real signs the tide is starting to turn. A number of our positions are trading well off their lows with 50-100%+ rises which have been coupled by significantly improved financial results.

We mentioned a few months ago that the catalysts to release that value included:

- A clear line of sight to the end of the rate hike cycle;

- Sustained evidence that inflation is reducing towards central bank targets;

- Data suggesting the resulting economic downturn is manageable;

- A subsequent focus back on growth companies leading to sector liquidity.

With recent announced inflation data, the first two have progressed positively and there has been some focus back on growth companies. Employment and cost-of-living data along with household debt remain of some concern for an economic downturn but a fall in interest rates should see this alleviated over time.

Recent company results, stock performances, and improvements in liquidity have given us a defined sense of optimism for 2024. There has also been increasing market talk of allocation to small caps being increased which should further improve sentiment and liquidity.

Dean Fergie and Graeme Carson

Cyan Investment Management

AFSL No. 453209

An investment in the Cyan C3G Fund can be made by clicking here