15 Jan 2024

We think most micro-cap and small-cap investors would join us in happily farewelling 2023. No doubt a challenging year on many levels. We have more than 50 years combined investing experience and believe 2023 to be amongst the toughest conditions we have experienced.

That said, at least the year ended on a positive note. Most developed markets rallied into the Christmas period, led by the DOW and NASDAQ with returns of around 5% for the month. Domestically, the larger end of the market was the strongest beneficiary of a positive shift in sentiment, with the S&P/ASX All Ords Accumulation Index delivering +7.4% and the S&P/ASX Emerging Companies Accumulation Index +6.5%. In fact, 78% of companies in the ASX 300 delivered a positive return for the month, bookended by biotechnology companies Neuren (NEU +61%) and Mesoblast (MSB -24%) and driven by corporate activity in Link Market Services (LNK +59%), Adbri (ABC +47%) and Sigma Heathcare (SIG +44%) who announced a reverse takeover with pharmacy behemoth Chemist Warehouse.

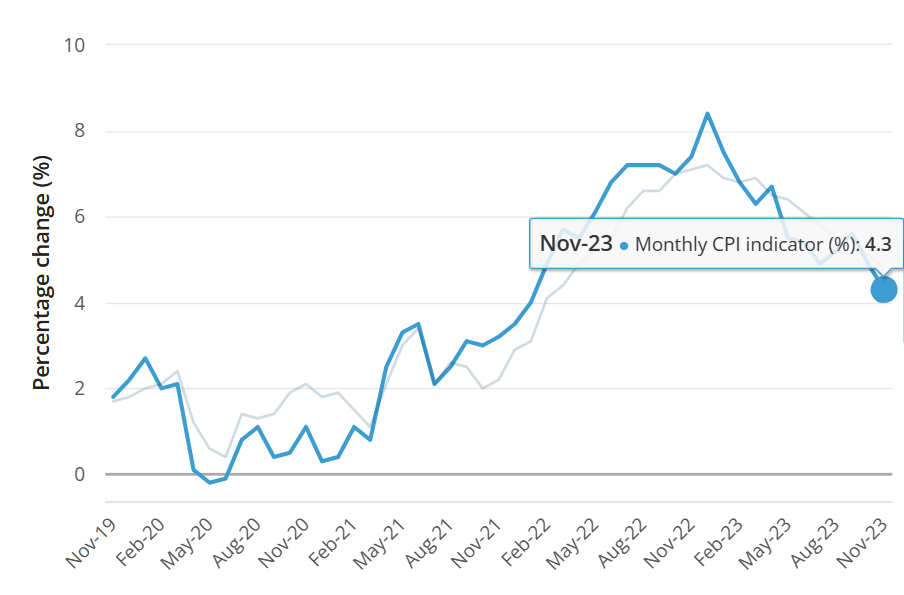

The Cyan C3G Fund delivered a monthly return of +1.8%, lagging the larger market. Hopefully this will improve as the year progresses, interest rates stabilise or indeed fall (which the most recent CPI number, a two year low of 4.3%, would underpin), and investor interest returns in a search for value at the small end. History shows that when the small end underperforms for a period (around 2 years in the current cycle), its recovery can be prolonged and material.

Month in Review

Lack of liquidity continues to impact the Cyan C3G Fund’s investment universe, but we feel sentiment is improving. 68% of our positions delivered steady or positive returns for the month.

Positive contributors:

- Playside (PLY) +17% (Game development). In recent months Playside has delivered strong cashflow performance and upgraded its already solid revenue guidance for FY24 to $55-60m. This momentum continued in December when it announced it has signed an agreement with Warner Bros Interactive Entertainment for a multi-game license to use “highly recognisable intellectual property” under license for the development of two PC/Console titles. There was no financial detail, but it is assumed to be a material opportunity. We see this as further validation of the quality of work and diversified business model.

- Entyr (ETR) +200% (Industrials): This industrial company has proprietary technology and processes around the conversion of used tyres into secondary products such as fuel, carbon products and steel. We took a small position through a capital raise in June with the view that the company was well positioned to scale its proven technology and was rich in share price catalysts off a relatively small base in terms of market capitalisation. Nothing came for months (and the share price dropped more than 50%), but in December Entyr announced agreements for product offtake and future collaboration with Trafigura, a Singapore-headquartered multinational commodity trading company. This is materially financial and strategical and we believe a major step towards further significant value creation.

- Silk Logistics (SLH) +7% (Logistics): This port-to-door landside logistics and supply chain services businesses has been sold down over the past 12 months. Other than general financial market weakness, the company has faced headwinds in some areas as the economic activity has slowed across verticals such a consumer discretionary spending. In 2023 the company traded down from share price highs of $2.55 down to $1.60. SLH enjoyed some respite in December rallying to $1.85, even though there was no clear catalyst by way of any company announcements. We expect some weakness in the December half result (as does the market), but we see it as priced-in and believe the company offers outstanding value and income (P/E <8, yield +5%) with strong growth in the years ahead.

- Readcloud (RCL) +24% (Education Technology): This provider of digital eLearning solutions to the Secondary Schools and the Vocational Education and training (VET) industries is small and has been a disappointing investment. That said, it has recently raised capital, refreshed the management team and has a much-improved outlook.

Negative Contributors:

- Schrole (SCL) -33% (Education Technology): In an interesting example of the current volatility, Cyan’s other exposure to Education Technology has been in a trading range of $0.15 and $0.33 since September, on low trading volumes, so extreme monthly performance is more an issue to timing than company performance. All SCL’s metrics are trending positively (most recent results sales up 17% yoy) and we look forward to some recognition for achievement in the year ahead.

- Raiz Invest -4.8% (Financial Services): This micro-investing platform company continues to struggle to find investment support in the short term. However, RZI has reduced costs and cash burn and is restructuring and selling its struggling Asian business. After a year of relatively flat performance, it has refocused its energy on driving top line growth in the proven Australian business and has recently run an ad campaign during the Australian Test Cricket series.

Probably the most disappointing ‘relative’ performance came from hospital software business Alcidion (ALC) +1.4% (Healthcare) which signed an eight year $23.3m extension to an existing contract with substantial UK hospital group, South Tees. Given the total market capitalization of Alcidion is less than $100m, this announcement was a materially positive development for the company.

Click here for a PDF of this newsletter

Media

For all articles, videos and commentary featuring Cyan Investment Management please head to the Cyan Investment Management Linkedin page.

Outlook

We are heartened by the improvement in sentiment towards the market but acknowledge that there will be continued skittishness at times, based on the macro environment and its impact on company specific performance. We hope that positive sentiment can be sustained and result in attention and capital to begin to flow back to small and micro caps.

As we enter a new year, we look for an improvement in volume into reporting season in February. We believe those companies that have taken this challenging period to reduce costs to right-size their businesses and focused on cashflow and balance sheet management will be best placed for the year ahead. These are the types of business we have been focusing on and believe the portfolio is well positioned.

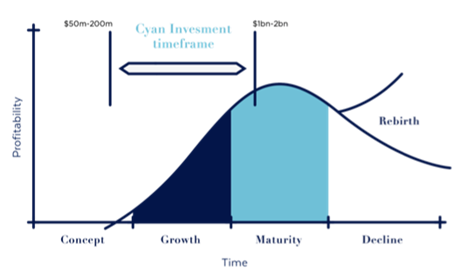

As stated in previous monthly reports, Cyan looks to invest in companies in their growth lifecycle phase, as illustrated in the chart below.

The portfolio, at any given time, has a mix of companies at various stages of their lifecycle. The chart below illustrates that we break the portfolio up into 3 main categories of cash and cash generative, growth and emerging. We then weight the investments accordingly.

The current portfolio composition is:

- Cash and cash generative ~37%

- Growth ~43%

- Emerging ~20%

It has been the “Growth” and “Emerging” investments that have been hurting performance through 2023. This is the part of the market that has underperformed the most and continues to face challenges with liquidity due to lack of both institutional and retail participation in the sector. In our opinion, this is the part of the market that provides the most potential upside in the recovery.

Patience is always tested at times such as these but, each time in history, the market has improved, and disciplined investing has been rewarded accordingly.

Dean Fergie and Graeme Carson

Cyan Investment Management

AFSL No. 453209

An investment in the Cyan C3G Fund can be made by clicking here