12 Oct 2023

The Australian share market, and most other equities markets around the globe, finished the September quarter on a weak note. For some time, investors have been trying to forecast the end to the rate-hike cycle, and although most agree we are either there or very nearly there, stubbornly high inflation has now resulted in the conversation shifting to “will rates stay higher for longer?”.

Whilst there were no changes to official RBA short-term rates (which have remained at 4.1% since June 2023) we saw a sell-off in domestic bonds with the Australian 10yr spiking 0.5% to 4.5% during September.

This negatively impacted equity markets in September: the ASX/S&P All Ords Accum Index -2.8%, the ASX/S&P Small Industrials Accum Index (XSIAI) -5.0% and the ASX/S&P Emerging Companies Index -4.9%.

The Cyan C3G Fund delivered a monthly return of -3.3%.

If we look a little deeper at the performance within the Small Industrials Index, 80% of stocks fell for the month, with an average retracement of 9.7%. The index being held up by the third largest stock, $8.7bn Promedicus (PME) which, with a modest return of 14%, was the second-best index performer.

Over the September quarter all comparable Australian share market indices were in the negative. The All Ords fell 0.7%, the Small Industrials Index was down 1.9% and, most notably, the Emerging Companies Index dropped 5.3%.

In contrast the Cyan C3G Fund delivered a marginally positive return of 0.1% for the quarter.

Month in Review

Liquidity has shown sporadic signs of improvement, but overall remains challenging. Company valuations continue to remain depressed, so an improvement in confidence is required to release the obvious inherent value.

Positive contributors:

- Swift Networks (SW1) +11.8% (Communication Services): This technology company provides entertainment and engagement media services across proprietary network solutions to the mining and aged care industries. Swift continues to win new contracts in mining and is gaining more traction in the aged care sector with $1.6m in new contracts announced this week. The company also settled a legacy ACCC dispute on terms that are not financially onerous to the company. All in all, SW1 is building good momentum in FY24.

- Playside (PLY) +7.0% (Game development): Playside rebounded from a sell-off late in the previous month. As stated in a previous monthly report, it recently announced a new game development contract with Meta and provided revenue guidance of ~$50m+ for FY24, which was ~20% higher than previous expectations of analysts. It is worth remembering that this represents organic growth from $10m to a forecast $50m+ in 3 years, equating to a compound annual growth rate of 69%. We would also argue that the quality of revenue has improved, given PLY now partners with some of the best of breed industry leaders. We remain long-term investors in the business.

- Readcloud (RCL) +8.0% (Education): This provider of digital eLearning solutions to Secondary Schools and the Vocational Education and Training (VET) sectors has a strengthening outlook, most notably in its VET business, under the guidance of its new CEO, Andrew Skelton. After raising $1.5m in August from directors and existing shareholders the company is now funded to execute its growth plans over FY24.

The materially negative contributors for the month are all companies that we strongly believe in over the medium term, but appear to have slid due to either lack of news flow and/or short-term headwinds:

- Raiz (RZI) -18.4% (Financial Technology): This micro-investing platform business has done a good job in turning around its cash-burn position, but lack of clarity around the Asian strategy appears to be of increasing frustration to investors. We expect a resolution to this and proof of the refocus on the successful Australian business to result in improved share price action. The company looks inexpensive across a number of metrics but the overhang of the outstanding issues needs to be addressed.

- Alcidion (ALC) -12.0% (Healthcare): This healthcare software provider is still waiting for the digitisation of the UK health system to gather pace. We understand that decisions around the award of contracts are imminent, which we expect will provide a strong share price catalyst.

- Big River Industries (BRI) -10.7% (Building Materials): This well diversified building materials company will continue to grow organically and through acquisition, but well documented short term industry headwinds appear to be weighing on sentiment and short-term growth in some sectors and geographies. The business is inexpensive and offers good yield with an 8c dividend declared in September, so we remain confident on its outlook over time.

Click here for a PDF of this newsletter

Media

For all articles, videos and commentary featuring Cyan Investment Management please head to the Cyan Investment Management Linkedin page.

Outlook

The Australian small and micro-cap markets remain challenging. Along with more recent geo-political factors, macro events continue to drive markets globally, most particularly the data around inflation, economic growth, wages and unemployment, and subsequently the Central Bank’s response across all developed economies

It is worth taking a step back from the daily, weekly, and monthly movements and remembering where we are in the broader cycle. Having navigated Covid, we are now working through the financial machinations. Interest rates are close to peaking, inflation is generally abating, economies are slowing but with a manageable downturn from both magnitude and timeframe. Smaller companies have performed poorly for almost 2 years (even excluding the strange Covid markets) and their valuations are depressed. Through that time numerous companies have re-based their costs structures and re-capitalised their balance sheets and cashflows have been closely managed. We genuinely believe that the smaller end of the market will outperform strongly as this part of the cycle ends.

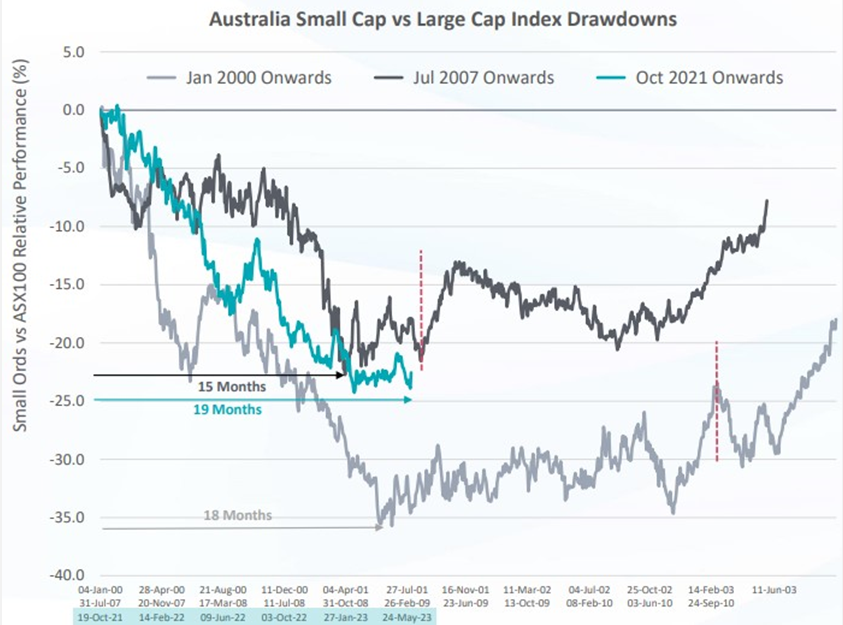

In June 2023 we presented the chart below which showed small-cap underperformance. This underperformance has now continued for 22 months, a historical record, but has shown recent signs of stablising.

Within the Cyan portfolio we have a diversified mix of businesses that have catalysts ahead, both from an operating perspective and with the potential for multiple re-rating when conditions improve. We continue with a high company visitation program, with both current and prospective investments.

Some economic and industry specific challenges remain, but in most instances, these are well and truly priced in at current levels.

As always, we thank our investors for their ongoing support and are available for contact if required.

Dean Fergie and Graeme Carson

Cyan Investment Management

AFSL No. 453209