11 Sep 2023

The Australian stock market was focused on the FY23 reporting season in August and the ongoing economic discussion around improving inflation and the RBA’s response in respect to interest rises. At the end of the month, specific company news appeared to be overwhelmed by press coverage of Qantas and its plunging public profile.

Markets were lower across the board, index returns for the month included the ASX/S&P All Ords Accum Index -0.7%, the ASX/S&P Small Ordinaries Accum Index -1.5% and the ASX/S&P Emerging Companies Index -4.2%.

After a strong July (up +7.2%), the Cyan C3G Fund retraced some of these gains to report a monthly return of -3.4%. The Emerging Companies index has faced similar volatility.

Annual inflation for June 2023 came in at 6.0%, well below the peak of 7.8% in December 2022, which has resulted in the RBA pausing rates at 4.1% for the past three months.

The RBA’s 5 September 2023 Statement on Monetary Policy by outgoing Governor Philip Lowe included markedly improving commentary including:

“The recent data are consistent with inflation returning to the 2–3 per cent target range over the forecast horizon and with output and employment continuing to grow. Inflation is coming down, the labour market remains strong and the economy is operating at a high level of capacity utilisation, although growth has slowed.”

FY23 results reporting saw some significant volatility, especially at the growth end of the market, with strong share performances from Altium (ALU) +25%, Audinate (AD8) +30%, Megaport (MP1) +20% and McMillan Shakespeare (MMS) +15% being countered by disappointments from Iress (IRE) -38%, Appen (APX) -32%, Judo Bank (JDO) -20%, and Wisetech (WTC) -20%.

The IPO market for industrials reopened with the listings of two health companies, Cleo Diagnostics (COV) and Curvebeam AI (CVB). CVB produces weight-bearing CT scanners and raised $25m at a market capitalization of $150m (Cyan did not participate). It endured a particularly wild start as a listed entity, with the first day of trade seeing the stock down 30% on its 48c IPO price before recovering strongly to end the month close to square.

Month in Review

There appeared to be some discrepancy between financial results and stock price performances throughout August. Of course, one month is not a significant timeframe but one would typically expect that financial performance would track short-term price movements.

We saw some share prices that defied solid financial results like warehousing and logistics provided Silk Logistics (SLH) -11.2% which reported a solid result given softness in container volumes with revenue up 24%, underlying EBIT up 15% and a full year of dividends of 8.4cps (a fully franked yield ~5%). Additionally, SLH has recently acquired a competitor in Secon Freight Logistics that is expected to materially increase revenues and be accretive to earnings. Given the company’s strong revenue growth, yield and attractive P/E multiple of just 8x – particularly compared with competitors like Mainfreight (MFT) and Qube (QUB) at 20x – we’re surprised the market hasn’t embraced the story more fully. With Secon coming online fully in 2HFY24 the company should see some significant market support and will prove current prices to be extremely attractive entry points.

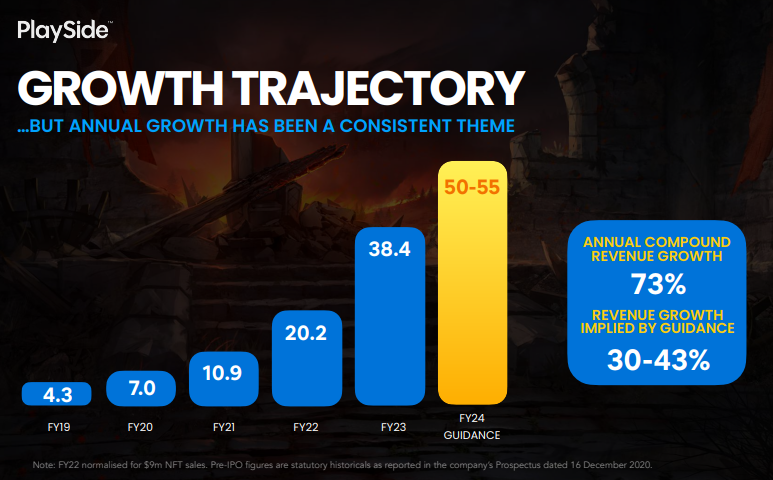

Another company that failed to reflect a good FY23 result (and a positive update to FY24 forecasts) was gaming developer Playside Studios (PLY) -18%, albeit the stock’s almost 50% rise last month must be a factor in the pullback. Playside posted impressive FY23 revenue growth with a 50% uplift in original IP revenue and 130% rise in its work-for-hire division. It also announced a new game development contract with Meta and provided revenue guidance of $50-55m in FY24, ~20% higher than previous expectations of analysts. Playside has pleasingly gained 10% to date in September.

Readcloud (RCL) -33% – RCL posted a 34% gain in July and has already traded 10% higher in September. This Melbourne based provider of digital eLearning solutions to the Secondary Schools and the Vocational Education and training (VET) sectors did not post results as it has a September financial year end (to align with seasonality in the yearly school purchasing cycle). Readcloud raised almost $1.5m to expand its business through an entitlement issue in which all five directors, senior management and major shareholders (including Cyan) contributed. Readcloud has a new CEO and we expect recent acquisitions will generate significant revenue, earnings and share price growth.

Some of our better performers this month, Swift Networks (SW1) +21%, Xpon (XPN) +20% and Entyr (ETR) +10% reported results broadly in-line with our expectations. Some explanations for these rises are that recent price weakness in the micro-cap end of the market has implied poorer underlying performance than is actually being experienced or that investors are beginning to acknowledge some underlying value inherent in the sector.

Media

For all articles, videos and commentary featuring Cyan Investment Management please head to the Cyan Investment Management Linkedin page.

Outlook

After a strong July it was disappointing for the Fund’s short-term performance to slip in August, although it was consistent with the pullback in the broader markets, most particularly at the smaller end.

Having had contact with all our core holdings through reporting season we’re confident the companies are on track for a solid FY24. This is particularly the case given the incredible value at which companies at the smaller end of the ASX are presently trading. Excluding Covid (during which small and emerging companies bounced 50-150%) the market is trading at its lowest price to growth ratio (PEG) in more than 10 years.

We see a several material catalysts for our holdings in the coming months including:

- Raiz (RZI) – An imminent decision regarding the future of the company’s fledgling Indonesian partnership will be financially positive and will allow management and investors to focus on the profitable Australian operation. Importantly Raiz increased prices across all its Australian accounts on 1 August 2023 and experienced minimal churn which will generate a material uplift in recurring revenue.

- Alcidion (ALC) – Whilst the company delivered an impressive positive cash-flow result in FY23, timing delays in new UK contacts to date in CY23 are expected to result in a backlog of new business for ALC in FY24.

- Quickstep (QHL) – Along with a push into the US market for the company’s aerospace division, a rebound in the company’s Aftermarket business as the airline industry continues outperform will be a material positive in FY24.

- Readcloud (RCL) – A new CEO and cash injection into the business will give it increased flexibility and marketing firepower to drive sales and profitability, particularly coming into the school sales season of October to March.

It appears the market is becoming increasing comfortable with the inflation and interest rate outlook in Australia which will flow through to improving local share prices.

We’re seeing an improvement in the IPO pipeline and a healthy market in respect to secondary raisings but we would like to see to see an increase in volumes which would result in lower month-to month volatility. As each month progresses, we’re feeling more positive and combining this with some historically low valuations, believe there is substantial room for upside across the portfolio.

As always, we thank our investors for their ongoing support and are available for contact if required.