| Click here for a PDF of this newsletter Any recent investor optimism was tempered during May as higher than expected wages growth fed into continued inflation (albeit at 7% off its peak of 7.8%) resulting in a resumption of RBA cash rate rises. The brief rate pause in April was followed by two 25bp hikes in May and June, taking the domestic official cash rate to 4.1% the highest level in over a decade (April 2012 of 4.25%). Despite a narrow rally in the US sparked by a handful of tech stocks (more specifically AI), most markets traded lower. The S&P/ASX All Ordinaries Accumulation Index fell 2.6% whilst the S&P/ASX Emerging Companies Accumulation Index finished the month significantly weaker, down 6.3%. The Cyan C3G Fund finished the month down 3.5%.

Month in Review The ongoing challenge of low liquidity and patches of both market optimism and skittishness resulted in share price volatility (in both directions) during the month. There were a handful of announcements from our investee companies and we initiated a couple of small investments in some new and promising businesses. Positive contributors: - Corum (COO) +18% (Healthcare Software): This was a major contributor last month and pushed higher again in May. Corum provides a technology platform known as PharmX to the Australian pharmacy industry that connects over 5,000 pharmacies to their suppliers and helps automate ordering and invoicing. Corum has recently been awarded a favourable judgement in its long-standing court battle with PharmX’s original vendor (Telstra owned Fred IT Group). This has amounted to a net payment of over $8m including costs and interest to Corum. Whilst this judgement is subject to an appeal, payment has been made and Corum will close the financial year with a profitable and growing business and around $14m on its balance sheet, more than half its current market capitalization.

- PureProfile (PPL) +15% (Communication Services/Advertising): PPL is an Australian and UK based market research and advertising company. In light of the significant drop-off in retail spending and associated advertising spend, PPL announced the closing of its online advertising division Pure.amplify. This division has been a drag on earnings for much of the year so, after closing-down costs, the decision to shut the business unit will have a positive impact on earnings in the new financial year.

- Swift Networks +14% (Media): This was another stock that has continued to rebound on improved financial results. SW1 provides an entertainment and engagement platform for the mining accommodation and aged care industries. It delivered its March quarterly cashflow result, illustrating its turnaround to cashflow positivity, complemented by new contract wins over the quarter. It is further proving its traction into its target markets and beginning to scale up to a truly commercialised level.

- Playside (PLY) +9% (Game development): Playside announced the first game title for its newly established publishing division. The game is being developed by the UK-based Rocket Flair Studios and is expected to be launched in early 2024. This deal signals a potentially material new revenue stream for the business in a relatively low-risk deal whereby PLY receives a share of the game’s revenue in return for publishing and marketing the title through its existing channels.

Negative Contributors: - Mighty Craft (MCL) -40% (Consumer Staples): MCL was easily the most significant detractor of performance to the Fund in the month. The decline was sparked by a market release in late May announcing a new non-executive Chairman and the commencement of a strategic review. Whilst there was nothing material in the release the market clearly got spooked by talk about reducing debt and looking to make divestments. No doubt this reaction was not helped by the fact that only two months earlier MCL raised $5.2m (a raising that Cyan did not subscribe to) to reduce debt and support the growth of the booming Better Beer range, of which MCL owns 33%. We would suggest that much of the selling pressure has come from, understandably, disgruntled shareholders that took shares in the placement and are liquidating before the end of the financial year.

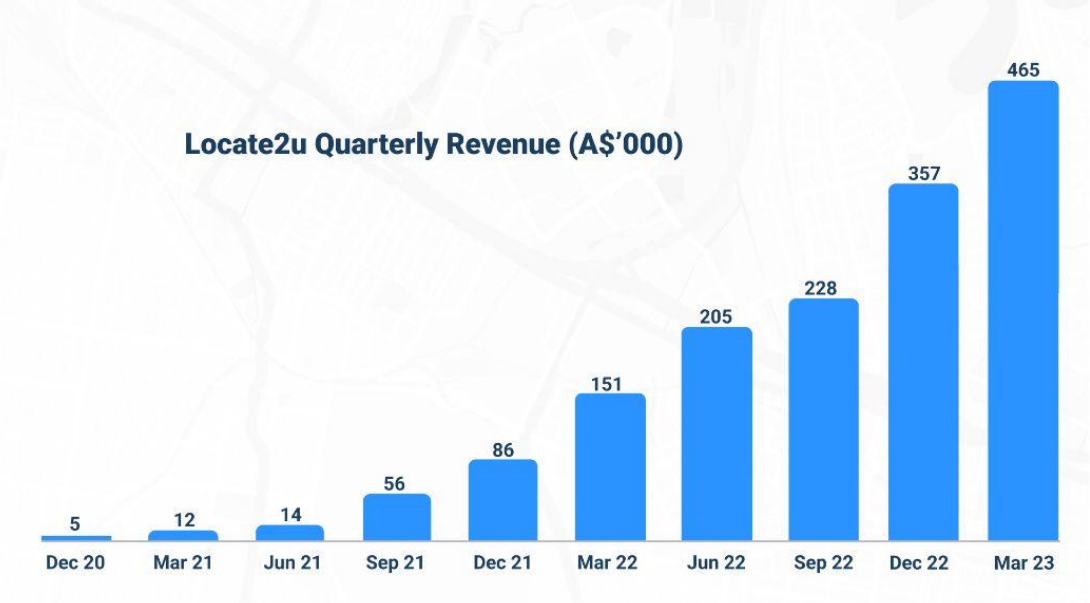

It is worth reiterating MCL’s valuation proposition: MCL’s current enterprise value is ~$43m and total sales for FY23 should total almost $90m. MCL owns the Adelaide Hills Group which was purchased in 2021 for $47m along with venues and brands such as Jetty Road Brewery, Hidden Lake and 78 Degrees Distillery. MCL owns a total whiskey under maturation of more than 530k litres. However, the jewel in the crown is MCL’s 33% stake in Better Beer which, applying historical metrics of $20 per litre of annual sales, value Better Beer’s 10m litres at $200m with MCL’s stake worth $67m. Additionally, MCL will ship a further 4m litres of beer primarily through its Jetty Road and Mismatch Brewing labels. - Zoom2U (Z2U) -18% (Logistics Software) Cyan visited last mile delivery network and software provider Z2U management in Sydney early in the month. Delivery volumes have been down year-on-year as retail spending has softened and fewer people are working from home – however the potential resumption of a large contract is likely to see growth restored. Most importantly its Locate2U software-as-a-service platform is producing strong month-on-month growth through marquee clients such Amart, Mayo Clinic (in the US), Bing Lee and Beaumont Tiles and, in the next year, the Locate2U division is expected to exceed revenues from its delivery division.

In term of new investments, Cyan took small placements in Beamtree Holdings (BMT) and Entyr (ETR). BMT is a fast-growing global healthcare technology provider with their software (some of which incorporates AI) deployed in more than 20 countries and annualised revenues of $20m. Entyr is one of Australia’s largest commercialised tyre recyclers that produces fuel, metals and road materials from recycled tyres. The company is seeing strong growth from its existing Queensland operations and is looking to expand further on the east coast. Click here for a PDF of this newsletter Media For all articles, videos and commentary featuring Cyan Investment Management please head to the Cyan Investment Management Linkedin page. Outlook Despite the weakness in the overall market there have been glimpses of positivity in the domestic market. The flow of secondary raisings has increased and, in several cases, these raisings have been oversubscribed. The excitement about AI and a strong rally in the NASDAQ have ignited some interest in the local tech sector and there has been some recent improvement in liquidity. There may be some patches of market weakness in June due to tax-loss selling, although this is not expected to be nearly as severe as in 2022. Interest rate rises, inflation and housing cost pressures are still hanging heavily over consumer confidence and as evidenced by a number of recent retailer downgrades from the likes of Adairs (ADH), Baby Bunting (BBN) and Universal Store (UNI). However some online retailers such as Cettire (CTT), Temple and Webster (TPW) and Kogan KGN) appear to be on the improve. In the past month we have meet face-to-face with the majority of our investee companies. Whilst many are frustrated (as are we) with their current share prices, their outlook and positivity with the value current share prices represent, and the likely upside when future results are delivered, are highly encouraging. As we stated last month: “Patience is always tested at times such as these but, each time in history, the market has improved, and disciplined investing has been rewarded accordingly. There is no silver bullet, but over time we think there is material upside in the portfolio and we, albeit somewhat impatiently, look forward to it being released.” We believe that, in the short term, a number of our investments are rich in catalysts, including: - Raiz (RZI) – the company is expected to restructure or close down its Asian operations any day now which will allow management (and the market) to focus fully on the profitable, and growing, Australian operations.

- Mighty Craft (MCL) – The recently restructured Better Beer asset is currently undertaking a capital raise, which will result in a strong uplift in the valuation of the MCL holding and illustrate the value that sits in the overall Mighty Craft business.

- Alcidion (ALC) – renewed two smaller NHS contracts during the month and we expect further contracts both in Australia and with the UK’s NHS system in the coming months, if not weeks.

- Quickstep (QHL) – a favourable outcome around the future of the QHL’s aftermarket (aircraft maintenance) business with client commitments would result in a material uplift in value. Whilst this has not been finalised or announced, the company alluded to positive progress in this division in a recent ‘speeding ticket’ from the ASX.

As always, we thank our investors for their ongoing support and are always available for contact directly. Dean Fergie and Graeme Carson Cyan Investment Management AFSL No. 453209 An investment in the Cyan C3G Fund can be made by clicking here |