12 Apr 2023

Click here for a PDF of this newsletter

March proved another difficult month for global markets driven by the collapse of Silicon Valley Bank (and subsequently two other regional US Banks) early in the month.

This sparked some initial market panic before its modest market relevance on the global stage (SVB had sustained loses of around US$15bn), central bank stability measures and the SVB’s eventual sale to HSBC UK reassured investors and prompted a promising comeback into the end of the month which has continued into April.

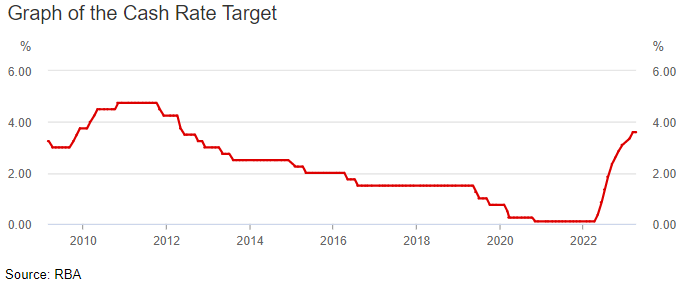

The RBA pushed through another 25bp rate rise in early March (the 10th in a row since May 2022) lifting official rates to 3.6%, their highest level since May 2012.

Importantly, the most recent RBA meeting on 5th April saw rates kept on hold, a welcome respite for borrowers and market participants with the caveat “…that some further tightening of monetary policy may well be needed to ensure that inflation returns to target.”

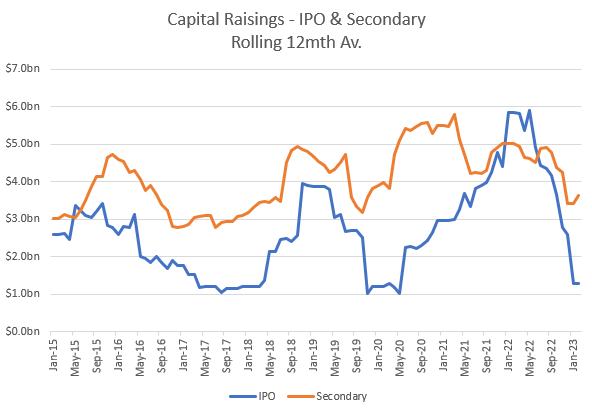

Whilst trading liquidity remained subdued at the smaller end of the Australian market, corporate activity experienced a significant uplift with a number of secondary market placements being completed including:

- Close the Loop (CLG) $40m

- Family Zone (FZO) $20m

- Top Shelf (TSI) $10m

- Weebit Nano (WBT) $45m

- Mighty Craft (MCL) $5m

- Frontier Digital (FDV) $10m

- MoneyMe (MME) $37m

- Little Green Pharma (LGP) $5m

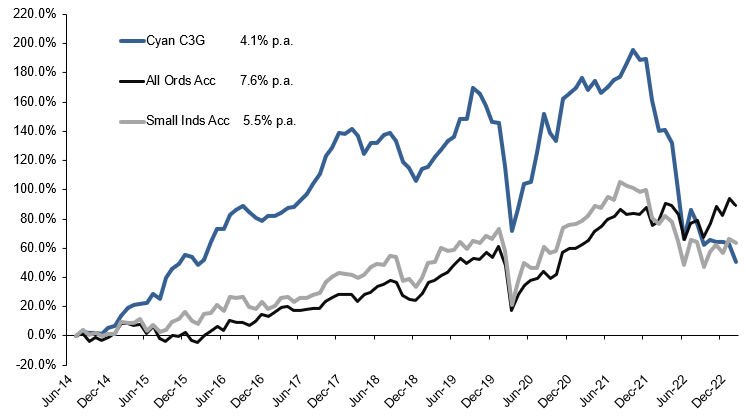

Whilst the S&P/ASX All Ords Accumulation Index closed down modestly at 0.2% the smaller end didn’t fare nearly as well with the S&P/ASX Small Industrials Accumulation Index falling 3.0% and the Cyan C3G Fund retracing a disappointing 5.3%.

Month in Review

Unusually, despite the downward movement in the Fund’s NAV over the month, there was nothing in respect to negative stock news that emerged in March. The main movers included:

- Raiz (RZI) -21%: The movement in the stock price can only be put down to market sentiment towards wealth mangers, particularly in the face of a destabilized market, certainly in the front half of March. Indeed Raiz has reported further growth in its FUM over March (+1.4% to $1.1bn) and is on track to deliver more cost savings as it exits its loss-making Asian operations in Malaysia and Indonesia.

Investment case: RZI has a current market cap of $35m, holds $10m in net cash and has almost 294,000 active Australian customers (with an average account balance of $3,750). This equates to an enterprise value per customer of just $85, compelling value given the cost of customer acquisition (CAC) in the banking system is estimated to be around A$300.

- Mighty Craft (MCL) -16%: MCL was the only holding in the Cyan C3G Fund that raised money during the month and it has been one of the few companies noted that has traded above the placement price post placement. MCL raised $5.2m (at 14.5c) primarily to support the enormous growth of Better Beer through marketing and promotions activities. With hospitability rebounding fully post-Covid, MCL is perfectly placed to benefit from ongoing consumer spending in the sector.

Investment case: MCL’s current market cap is ~$60m. Total sales for FY23 should come close to $90m and at the end of FY23 the company is forecast to hold more that 530k litres of maturing whiskey, conservatively valued at $50m. However, the jewel in the crown is MCL’s 33% stake in Better Beer which, applying historical metrics of $20 per litre of annual sales, value Better Beer’s 10m litres at $200m with MCL’s stake worth $67m. Additionally, MCL will ship a further 4m litres of beer primarily through its Jetty Road and Mismatch Brewing labels.

- Touch Ventures (TVL) +3.3%: TVL announced the sale of its investment in open market banking platform Basiq for A$14m, a 40% premium to its $10m carrying value. This is the first investment exit by TVL which settled at the end of March.

Investment case: Post the completion of the Basiq transaction, TVL holds ~$64m in cash – around 9.1 cent per share not including other strategic investments of another $64m. As such TVL (at its current price of 9.4c) is trading almost at its net cash with almost no value is being ascribed to its existing portfolio of investments. Given one of TVL’s foundation assets has just been sold at 40% premium to carrying value, it appears remarkably conservative for the market to value the remaining $64m of assets at ~$3m.

Whilst we have mostly focused on the negative positions this month there were a handful of stronger performers including Swift Networks (SW1) +20%, Zoom2u (Z2U) +6% and Playside Studios (PLY) +5%. Other than SW1 which won new contacts worth more than $4m, these moves were on account of modest market liquidity.

Click here for a PDF of this newsletter

Media

For articles, videos and commentary featuring Cyan Investment Management please head to the Cyan Investment Management Linkedin page.

Outlook

As we have tried to illustrate in our “Investment case” notes above, there is some remarkable/ridiculous pricing occurring in the market which simply has to be unlocked at some point in the future.

The marked increase in corporate activity is definitely a sign that sentiment is improving and the recent pause in interest rate rises has additionally added some positivity to market conditions.

Liquidity is still yet to return in any big way but as we mentioned last month “The silver lining with low liquidity is that it can magnify share price movement on the upside as well as the down when investor interest returns”.

It’s important to remember that the market at the smaller end is enduring its largest pullback since the GFC and is almost as severe as the dotcom crash of 2000-01. This is a once in a decade or two event and is resulting in some extreme quantitative value.

As such, with our eyes firmly on underlying company assets and valuations, it does give us some near-term optimism, despite our acknowledgment that the Fund has performed poorly of late.

As always if you would like more information about any aspect of your investment, please contact us directly.

Dean Fergie and Graeme Carson

Cyan Investment Management

AFSL No. 453209

An investment in the Cyan C3G Fund can be made by clicking here