09 Mar 2023

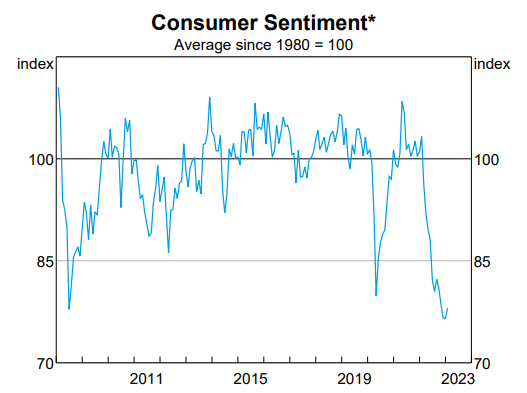

| Click here for a PDF of this newsletter February saw decade low consumer sentiment in Australia and renewed inflation concerns (and associated interest rate rises) being the main contributors to ongoing market bearishness. Central bank interest rate hikes in Australia and the US (RBA +0.25% to 3.35% and US Fed +0.25% to 4.75%) impacted both markets with the US S&P 500 falling 2.6% and the ASX All Ords declining 2.5%.

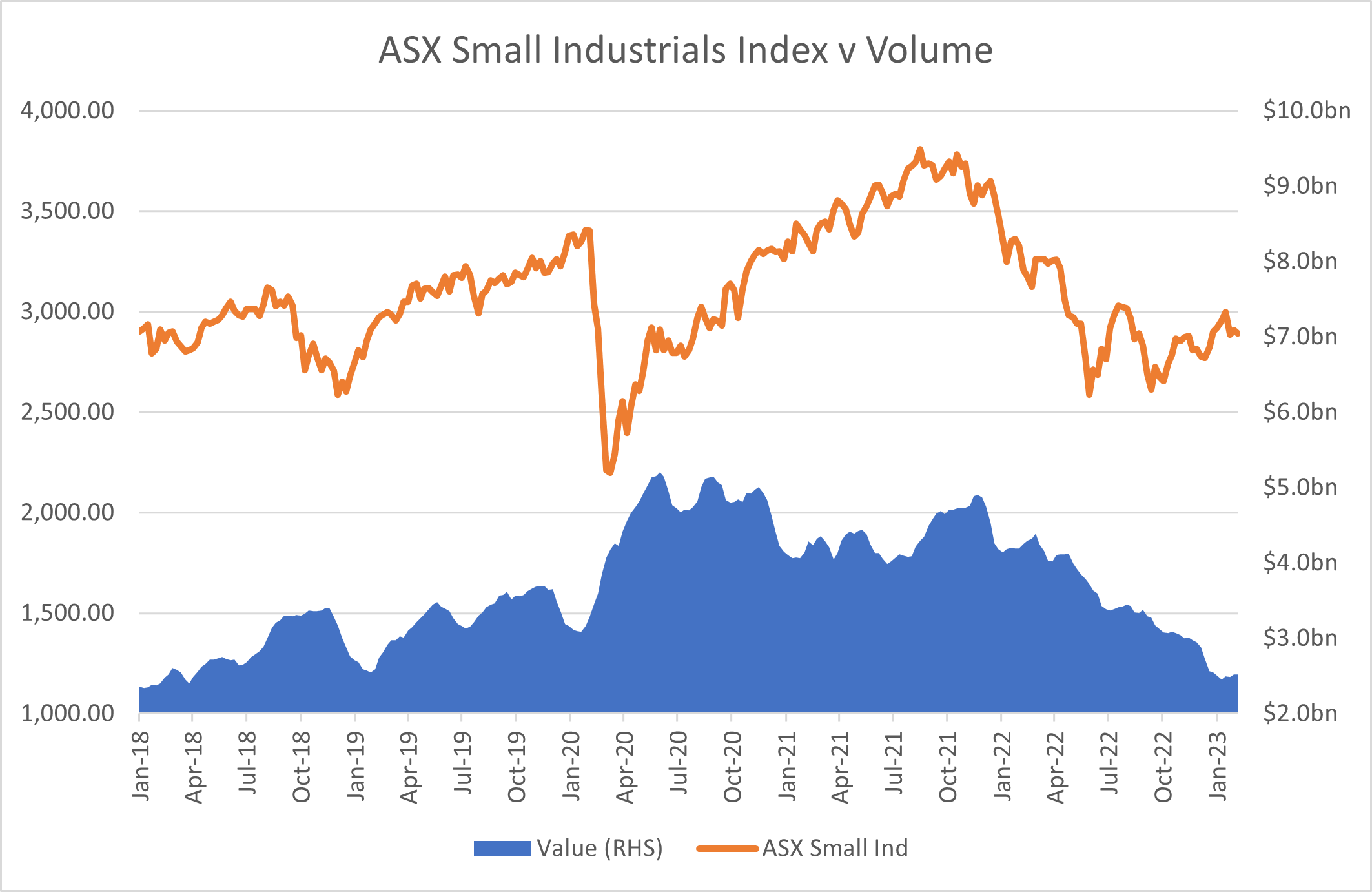

Liquidity continued to be extremely light in the domestic market (the lowest in 5 years and down 50% year-on-year) which contributed to an acute fall in the S&P/ASX Emerging companies index in February (-6.1%). The Cyan C3G Fund endured a couple of disappointing stock outcomes but was mostly impacted by the light liquidity which saw the Fund retrace a regrettable 7.7%.

Month in Review Given the fall in the Fund there were few stocks that gained ground in the month and several that sustained moderate price declines. Even in the face of some positive half year results, which included Raiz Invest (RZI) -9.0%, Mighty Craft (MCL) -11.6% and Alcidion (ALC) -6.9%, the selling, albeit light in volume, seemed to be reflective of investor disinterest in the smaller end of the ASX.

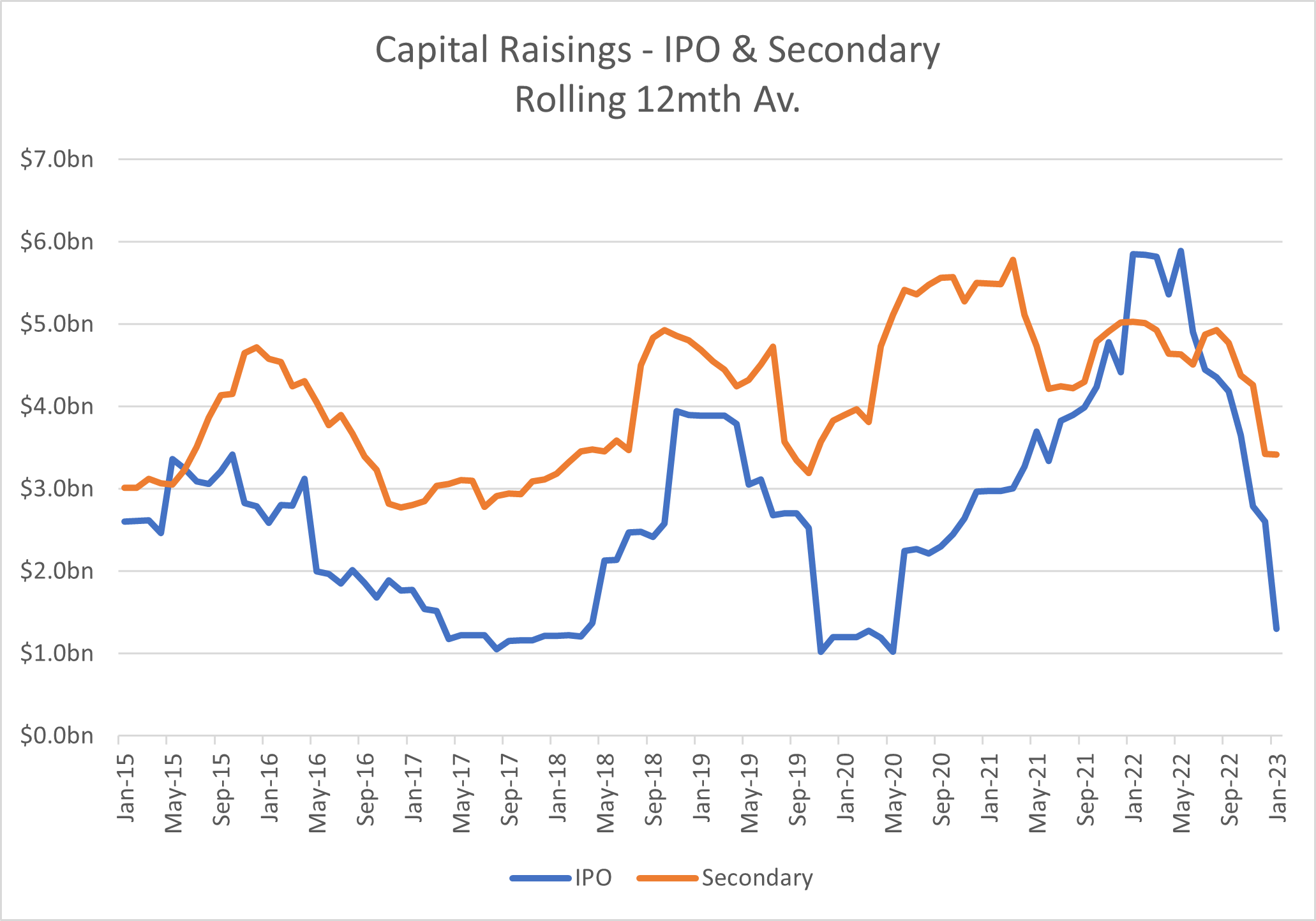

Click here for a PDF of this newsletter For articles, videos and commentary featuring Cyan Investment Management please head to the Cyan Investment Management Linkedin page. Outlook The Fund continued to underperform the broader market to the end of February which has been extremely disappointing given the optimistic investment views we’ve held for our positions. In a number of instances, particularly in the tech space, there has been a material pullback in the market valuation of these sectors which has impacted prices regardless of underlying performances. If we take two of our more material positions, in Raiz and Alcidion, their revenues, earnings and client bases have expanded over the past two years and yet their prices have declined by more than 50%. Whilst it could be argued prices did get ahead of themselves during 2020/21, the disconnect between underlying company performance and share price movement cannot continue indefinitely. We also own stocks such as Touch Ventures (TVL) and Birddog (BDT) which are trading at or near their net cash backings, excluding all other company assets and inventories which, in total, amount to almost 100% more than their current market prices. Again, this seems like a market anomaly that is not sustainable. There are still headwinds in the market, a lack of corporate activity which has declined markedly from two years ago, diminished investor engagement and associated low volumes and, for the moment, higher interest rates. Again, these are all negative factors that are occurring simultaneously, but cannot continue indefinitely. The silver lining with low liquidity is that it can magnify share price movement on the upside as well as the down when investor interest returns.

Of course, the timing of such turnarounds is difficult to predict, but our experience in the past has been when investor exasperation is at a peak, and most selling has impacted the market, this is often the time when the tables turn. Some optimism can be taken from the most recent RBA rate decision on 7th March (in which the RBA raised rates from 0.25% to 3.6%) that indicated there may be a pause in further rises, a distinct change from prior commentary. That, combined with some extreme quantitative value in the marketplace, gives us some near-term optimism, despite our acknowledgment that the Fund has performed unacceptably poorly of late. Dean Fergie and Graeme Carson

Cyan Investment Management AFSL No. 453209 An investment in the Cyan C3G Fund can be made by clicking here |