12 Jan 2023

Click here for a PDF of this newsletter

December rounded out a challenging year for domestic equity markets (along with almost all asset classes) with the S&P/ASX All Ords Accumulation Index posting a return in the month of -3.3%. Albeit this was better than the US experienced, with the S&P 500 falling 5.9% and NASDAQ diving 8.7 %.

Due to a couple of good individual stock performances within the portfolio, the Cyan C3G Fund held up well against the weak markets producing only a small decline of -0.1% in December.

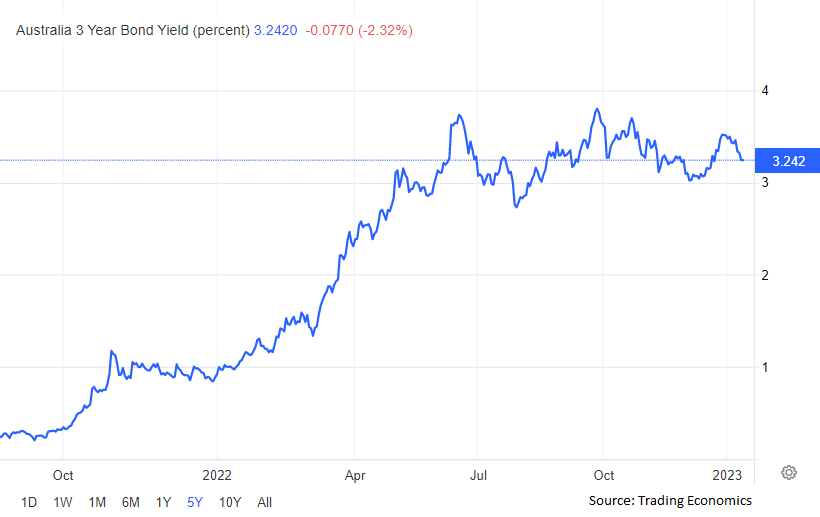

Interest rate rises continued to be front page financial news with the US Fed raising rates again by 0.5% in December (to 4.1%) and the RBA ratcheting up the official cash rate another 0.25% (to 3.10%) – the eighth month in a row of rate rises here in Australia. Whilst the RBA has not ruled out further rate hikes there is an expectation that the tightening cycle is close to peaking with 3-year bonds presently trading at 3.2%.

Click here for a PDF of this newsletter

Month in Review

We had two companies that gained more than 20% in the month, market research firm, Pure Profile (PPL +21%) and advanced composite manufacturing business, Quickstep (QHL +24%).

Oddly, given the price rise, there was no price sensitive news out about PPL in the month. But as we have mentioned previously “we continue to believe that PPL is building a strong position in a growing market which has structural tailwinds”. PPL’s market research capability is proven in Australia (generating $12m in revenue in the first quarter of FY23), it has strong traction in the UK, is entering new jurisdictions such as the US and, with a market cap under $50m, it offers attractive fundamental value given its proven capability and scalable, software-based business model.

Quickstep has three divisions: Aerostructures is the largest and manufacturers aerospace parts for the F35 fighter jet and C130 bomber; Aftermarket provides commercial aerospace maintenance services for airlines such as Qantas, Jetstar and Virgin; and Applied Composites produces high end composite products for drones and medical equipment. Whilst QHL did not deliver any new news in the month to spark the price surge, in the past few months it has increased the value and terms of its F35 order to US$105m over 6 years along with a A$5.4m in applied composite orders from drone manufacturer Swoop Aero. Even after the price gain this month, the company has a modest market capitalisation of $40m and has forecast sales for FY23 of $100m and EBITDA of $6.5m making it one of the cheaper listed stocks on the ASX. Additionally, it likely to benefit further from onshoring of maintenance services in the airline industry, increased defence spending and development and use of drone technology.

The fund also enjoyed gains from building materials company Big River (BRI), Readcloud (RCL) and Raiz (RZI), albeit they were countered by small losses in Mighty Craft (MCL), Field Solutions (FSG) and Xpon (XPN).

In a sign that that market, particularly at the smaller end, is overwhelmed with the kind of bearish sentiment that fixates on bad news and ignores the good, Alcidion (ALC -8%) announced an $8.4m extension to its, already, largest contract as part of a consortium providing IT health services to the Australian Defence Force. This follows the announcement early in the month of the securement of a contract with the Southampton NHS Trust in the UK, with a total value of up to $13.8m. It is quite baffling, given the materiality of these contracts for the company, that stock ended up falling in the month.

Touch Ventures (TVL -18%) was the poorest performer for the Fund in the month after it wrote down the carrying value of some of its holdings in unlisted investments such as Sendle and Till Payments. Given the severe pullback in technology valuations during the year this was certainly not unanticipated, although we would have hoped/expected(!) that their investment instruments in these companies such as convertible notes and preferred equity would have provided greater downside protection. In any case, the market appears far too pessimistic given the company has 8c per share in cash (versus a 9.4c market price) plus an additional 10c in unlisted investment assets (previously 15c).

Media

For articles, videos and commentary featuring Cyan Investment Management please head to the Cyan Investment Management Linkedin page.

Outlook

At the risk of sounding contrarian, we’re feeling somewhat optimistic about calendar 2023. Of course, there are many challenges on the horizon such as inflation, ongoing geopolitical issues, the prospect of more rate rises and further price declines in the domestic property market. However, we firmly believe these risks have been comprehensively broadcast and, given the decline in stock prices over the past nine months, well and truly factored in. There simply has not been any positive news of late and investors appear to have forgotten that prices do go up as well as down. The lack of liquidity across the board in the domestic market is a pertinent barometer of the lack of investor interest.

Being close to the businesses in which we’re invested, we are not seeing anything like the negativity that is reflected in the day-to-day price movements. Perhaps the spikes in some holdings in December (without any associated material news) is a sign that some pockets of the market are beginning to find investor interest in the value being presented.

Other than some end of January cash-flow reports, we expect news-flow to be quiet up until reporting season begins in February, although the typically lower liquidity in January can sometimes see prices spike. It can be difficult to retain long-term investment views when the market feels so short-sighted, but we fully expect that the companies in which the Fund has invested will be looking forward to reporting some solid revenue and earnings growth in the February reporting season. Hopefully this will contradict the recent bearish price movements and provide some clear insight into the longer-term growth path that these businesses are on and will be a trigger point for renewed investor interest.

As always if you would like more information about any aspect of your investment, please contact us directly.

Dean Fergie and Graeme Carson