11 Oct 2022

Click here for a PDF of this newsletter

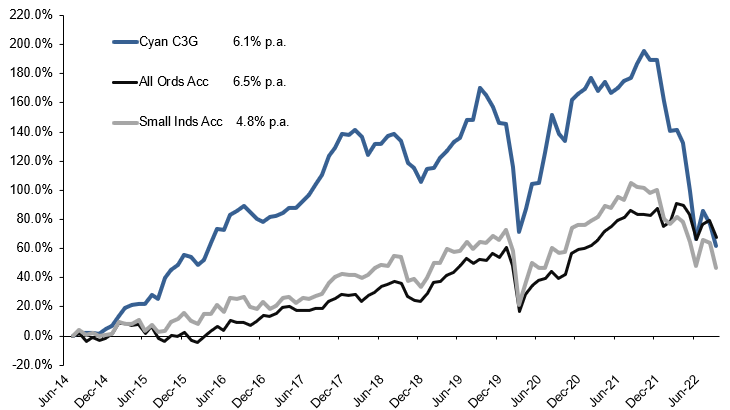

Global equities markets continue to endure severe volatility, unfortunately with a familiar downward trend. September was a particularly bad month in global markets (S&P 500 -9.4%, NASDAQ -10.4%), resulting in the US stock market having now experienced its worst first 9 months of a calendar year in 20 years.

The Australian economy appears to be in a stronger position than some of its counterparts, but the financial markets aren’t yet reflecting this. As has been the case over the past 2 years, smaller companies were hit the hardest with the S&P/ASX Small Ords Accumulation Index dropping 11.2% in September, the S&P/ASX Small Industrials Accumulation Index falling 10.4% for the month, whilst the S&P/ASX All Ordinaries Accumulation index fared ‘relatively’ well, shedding 6.4%

The Cyan C3G Fund was not spared, albeit performing better than comparable small indices, delivering a return of -8.4%.

September also proved to be challenging for bond and currency markets (this calendar year the S&P/ASX Australian Government Bond Index has fallen 12.1% whilst the AUD has dropped 11% against the USD) as central banks try to find the balance between managing unusually swift and aggressive rate hikes to appease inflation whilst hoping for an economic soft-landing to avoid recession. Governments also find themselves treading a fine line with fiscal policy, election promises, employment, wages pressures and cost of living challenges.

The economic reality that the market has been fearing and pricing appears to be upon us, which may be the beginning of the next phase and provide hope that financial markets will front-run the recovery just as they did the downturn…as they have with all bull and bear market cycles in the past. We discuss the “rate-hike cycle” and its impact on financial market sentiment later in the report.

Click here for a PDF of this newsletter

Month in Review

As might be expected given the bearish backdrop, the majority of our positions experienced share price weakness. With reporting season completed in August there was little news at the company level, so the movements were largely be attributed to sentiment and lack of liquidity particularly at the small end of the market. Share price movements aside, we continue to be heartened by the underlying operating performance of our holdings, and believe they are well positioned to deliver strong returns when markets improve.

As a medium to long-term investor with a growth focus, we’ve outlined our investment rationale for some of our key portfolio positions below:

- Alcidion (ALC) -12.1% in Sept (Healthcare/Software): ALC is building a strong position in the digitisation of hospital management systems, both administrative and clinical, in Australia and the much larger UK market. The company has worked hard to become one of the leading providers (ALC generated $34m in revenue in FY22) and the timing looks perfect to scale the business significantly over the next 2 years as governments drive the push towards technology in healthcare in a post-Covid environment.

- Xpon (XPN) -13.9% (Info Tech): Similarly, we are invested in this marketing technology business to gain exposure to a structural shift – in this case, towards a requirement for businesses to build first party data for digital marketing. The moves by the major browser providers of Google and Apple away from 3rd party cookies will accelerate in the short to medium term. XPN already delivers strong annual recurring revenue and we forecast significant organic growth going forward. XPN has been listed less than a year so hasn’t had a great chance to be recognised by the market due to the bearish market conditions.

- Raiz (RZI) -18.7% (Financials): Most of our readers will be familiar with this story. The environment has proved challenging for a micro-investing platform as retail investors have been reluctant to invest in a weakening market, additionally, as we wrote last month:

“Unfortunately, costs expanded more than we expected in the year and revenue generation from Raiz’s expansion into the Asian markets … have certainly not produced acceptable financial outcomes. We’ve been highly engaged with both the board and management of the company to renew focus on the domestic business and cut back on any further investment in non-profitable jurisdictions.”

This played out in late September with the appointment of a new Chairman and re-structuring of management. We now believe that a strategic review will drive a re-focus on, and directing of capital towards, the successful Australian business and away from an expensive and largely unsuccessful push into Asia. We now see a clearing path to a strong recovery of this scalable, recurring revenue generating financial services business.

- Raiz (RZI) -18.7% (Financials): Most of our readers will be familiar with this story. The environment has proved challenging for a micro-investing platform as retail investors have been reluctant to invest in a weakening market, additionally, as we wrote last month:

- Playside (PLY) -14.3% (Consumer Disc/Gaming): This gaming business continues to impress with the execution of its growth strategy through a business model based on work-for-hire, original IP development and new initiatives like a 3rd party publishing division. In short, an exceptional team with a strong and growing business in a strong and growing industry. We believe Playside can deliver great returns to shareholders independently or as an M&A target in time (hopefully both). We see this as a unique opportunity to get exposure to these dynamics in the ASX listed space.

- PureProfile (PPL) -25.0% (Consumer Disc/Advertising): Although marginally disappointed by the recent bottom line profit numbers, we continue to believe that PPL is building a strong position in the market research and customer data space which has strong structural tailwinds (such as those that XPN are targeting). PPL is proven in Australia, has strong traction in the UK, is entering new jurisdictions and offers good fundamental value.

- Field Solutions Group (FSG) -20.8% (Telco): This Australian telecommunications company is building an interesting business whereby it builds and owns strategic infrastructure assets and also offers core IT and communications services. At the small end of the market, the sector is currently out of favour (even more so than most), but it could well be a material beneficiary of a structural shift in the way rural regions are provided with their telco and IT services.

- Mighty Craft (MCL) -21.2% (Cons Staples): The alcohol industry globally is dominated by a handful or powerful players, but the domestic industry has been growing strongly in recent years. Inevitably the successful domestic businesses or alcohol brands are acquired as they obtain, or are on a clear path to obtaining, reasonable market share. In the ASX listed space there are a handful of “small” alcohol companies, all of which have slightly different business models. We think it’s a sector worth being exposed to and MCL is our preferred business model, whereby they acquire and accelerate growing beer and spirits brands through provision of capital, distribution and retail and wholesale points of presence. They take a portfolio brand approach, rather than all in. Better Beer is likely to be the first brand to prove up this model, both strategically and financially.

We direct our investment capital towards a diversified portfolio of businesses that are commercially proven and well positioned to capitalise on opportunities within their chosen field of expertise. Whilst the expected outcomes do not always emerge in the manner or timeframe originally expected, as we stated in one of our recent monthly reports:

“…resilience and discipline are required and we continue to take the same approach that we have over the past 25 years, and, in a strange way, welcome the fact that this downturn means that genuine fundamental valuation techniques will be more important than they have been for the past 3 years. That is how we invest.”

Media

For articles, videos and commentary featuring Cyan Investment Management please head to the Cyan Investment Management Linkedin page.

Outlook

As we have pointed out with our key investment positions earlier in this report, we invest on a bottom-up fundamental basis where we find individual companies that are small but well positioned in their chosen industry and will provide growth over time and through economic cycles. In our view, all the companies we listed will have materially stronger market share positions in their industry in years to come, irrespective of economic conditions. In other words, we find oud our opportunities using a “micro” or “bottom-up” approach.

That said, “macro” influences can’t be ignored, at two levels: 1) The industries in which our investee companies operate, and; 2) The impact this has on sentiment towards financial markets. In our view, these macro influences impact the timing of the outcome rather than materially change the eventual outcome itself.

Some of the macro-led impacts are beginning to be felt in the economy and at company-specific level, but the financial markets have, as always, front-run this by declining heavily ahead of the actual impact. It also more than likely, as is generally the case, that they will recover well-before the economy recovers.

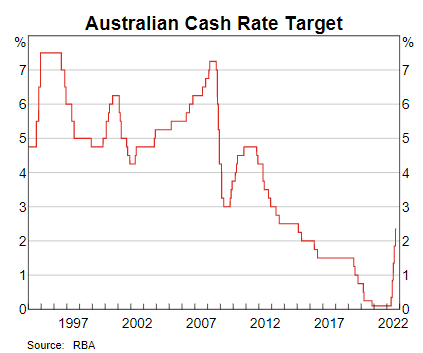

We believe the most-likely first positive catalyst for a stock market recovery will be a line of sight as to when the interest rate hike cycle will end. Most central banks in developed economies are rapidly and aggressively raising rates. Stock markets hate this. We don’t know if this monetary policy strategy will curb inflation as hoped, but an end to this cycle could provide a clear positive catalyst for a shift in sentiment for equities. It is expected that this will occur in the US in the first quarter of Calendar 2023. Perhaps the same case in Australia, or a month or two earlier. We experienced the first taste of this when the RBA raised rates for the sixth consecutive month in early October, but by only 25bp rather than 50bp. The market rallied strongly.

We think one of our fellow fund managers, Geoff Wilson, made some good points in a recent article he wrote for the Australian in regard to the rules of investment that continue to be proven over time:

“Every bull market is inevitably followed by a bear market; compounding is magic; earnings are king; and it’s hard to beat good, old-fashioned, bottom-up research. I am constantly amazed by how often these basic rules are forgotten at various points in the market cycle”.

As always if you would like more information about any aspect of your investment, please contact us directly.

Dean Fergie and Graeme Carson

Cyan Investment Management

AFSL No. 453209