16 Aug 2022

Click here for a PDF of this newsletter

Global markets offered some welcome respite after months of poor performance. The Australian markets followed the 6.7% rise in the Dow Jones and 12% rise in the NASDAQ with the All Ords Accumulation Index and S&P/ASX Small Ords Accumulation posting positive returns of 6.3% and 11.4% respectively.

The local stock market surge was in the face of the RBA again raising rates by 50bp on the 6th July and in light of the expectation of the 50bp rise that occurred on 3rd August.

The Cyan C3G Fund also recovered well through July, delivering a return of +11.8%.

Click here for a PDF of this newsletter

Month in Review

Many positions within the portfolio rebounded from the impact of the tax-loss selling we experienced in June 2022, with 19 of our 21 positions trading positively. Share price movements aside, we continue to be heartened by the underlying operating performance of our holdings, as evidenced by the release of a number of solid quarterly cashflow statements through the month. For the first time in a while, positive company news was rewarded by the market.

The most notable performers were:

- Alcidion (ALC) +41%: This healthcare software business delivered impressive 4th quarter cashflow numbers, rounding out a very solid year in a challenging environment. ALC signed $14.8m of new contracts in Q4 alone and revenue for FY22 was up 31% on FY21 to $34m. ALC is in a very strong position to cement its presence in the accelerating digitisation of hospital systems and electronic medical records (EMRs) in the UK, Australia and New Zealand.

- XPON (XPN) +58%: We see this marketing technology business as a great way to gain exposure to the structural shift towards a requirement for businesses to build first party (company owned) data for digital marketing. The material move away from personal privacy threats such as website tracking 3rd party cookies continues to accelerate as Microsoft, Google and Apple (along with independent providers like Brave, Firefox and Opera) tighten their browser security systems. XPN already delivers ARR of $16m (+78% YoY) and expects significant organic growth going forward. A relative newcomer to the ASX, we expect it to garner attention of investors as revenue builds and new clients are signed up, adding to existing enterprise clients such as Dominoes, Flight Centre and Super Retail Group. The most recent quarterly cashflow statement confirmed our confidence showing revenue growth of 134% YoY.

- BirdDog (BDT) +43%: The BDT share price has struggled since listing in December 2021, just before the tech route began. The company’s financial performance has been somewhat below expectations posting revenues for the FY22 only in-line with FY21 due to supply chain and componentry constraints. Having built up inventory in both existing and newly developed video technology products, it now looks much better placed to deliver strong organic growth over the next 12 months. We expect revenue to grow well in excess of 20% from its $38m FY22 base.

- Playside (PLY) +28%: We have written about the growing success of this game developer previously and the business continues to expand with a newly formed publishing division announced in late July. In FY22 PLY grew revenues 169% to $29m, expanded its team considerably and has a spate of exciting game releases and milestones across FY23 and, importantly, has a very strong balance sheet backed by almost $38m in net cash.

Obviously, the true underlying value of companies such as Alcidion, XPON and BirdDog have not increased by more than 40% in a month even though their share prices have spiked upwards (having fallen considerably in previously months, for reasons largely unrelated to fundamentals). These are the markets we are dealing with and as stated in our May monthly, “resilience and discipline are required and we continue to take the same approach that we have over the past 25 years, and, in a strange way, welcome the fact that this downturn means that genuine fundamental valuation techniques will be more important than they have been for the past 3 years. That is how we invest.”

Just as we did not get overly pessimistic or concerned about the underlying business operations in the face of a diving market in late FY21, nor do we become arrogant, overly optimistic or complacent when share prices are spiking higher. We keep our eyes on the company valuations and our ears tuned to the business fundamentals and make investment assessments based on the combination of the two.

Media

For articles, videos and commentary featuring Cyan Investment Management please head to the Cyan Investment Management Linkedin page.

Outlook

As illustrated by the extreme share price movements, the market is still grappling with how to treat the global and domestic macro issues of Central Banks handling of inflationary threat and the resulting economic landscape (not to mention ongoing geopolitical risks). These are the macro influences that are almost impossible to accurately forecast – even the RBA has gotten it wrong “RBA concedes its reputation has suffered“. For that reason, we focus more at the micro, or company, level. Obviously, the macro environment causes associated issues at the company level, including costs pressures, supply chain, business confidence, consumer confidence and discretionary spending levels. These challenges will abate over time, but need to considered and respected in the short-term.

What we can say is, the companies in which we are invested are, generally speaking, delivering to our expectation, emerging from the current challenges and are well positioned for the next 12 months.

We still see a gap between price and value in many of our holdings. However, with sentiment feeling more positive, and with reporting season approaching, we hope that some of that inherent value will be released in the short to medium term as the market re-focuses on quality, growing companies and fundamental research. Hopefully sentiment remains positive for a period of time.

We welcome the upcoming reporting season and expect some key themes to emerge. It is likely that management will be non-committal in regard to forward-looking statements, so we have positioned the portfolio towards well capitalised businesses with a growth ambition. In the short-term there is likely to be a focus on cost-control with a medium-term view to growth. Consumer-facing business will be closely watched.

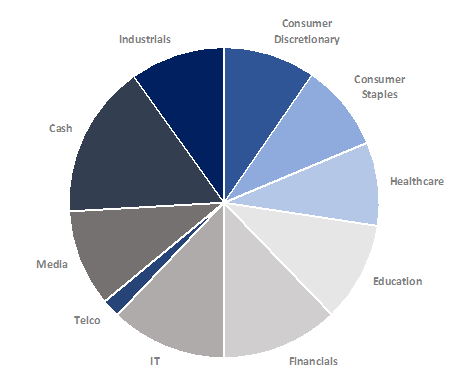

Our portfolio is well-diversified with a broad exposure across industry sectors and with companies at various stages of their growth lifecycle.

As always if you would like more information about any aspect of your investment, please contact us directly.

Dean Fergie and Graeme Carson

Cyan Investment Management

AFSL No. 453209