10 Feb 2022

| Click here for a PDF of this newsletter

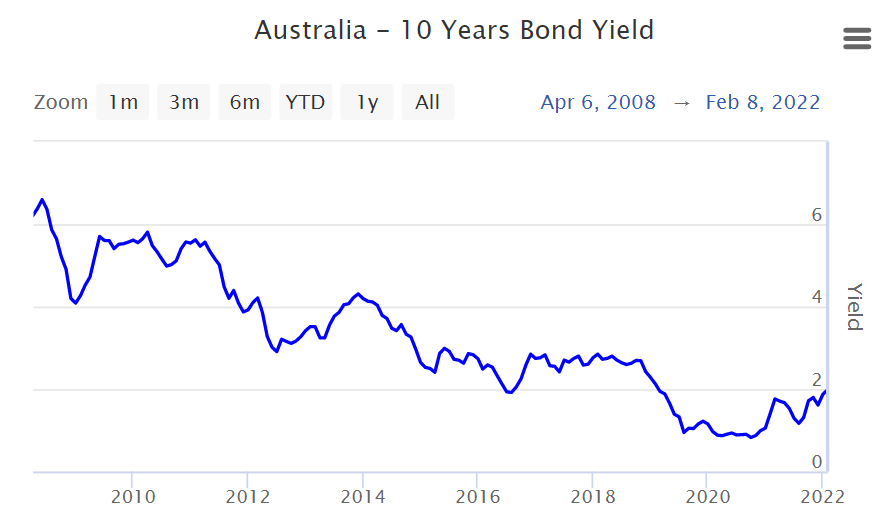

Inflation fears terrorised the markets in January with indices reporting their worst monthly falls since the Covid-19 induced dive back in March 2020. The S&P/ ASX All Ordinaries Accumulation 6.6% and the S&P/ ASX Small Industrials Accumulation Index fell 9.8%. The Cyan C3G Fund also felt the brunt of the bearishness declining 9.8% in the month. Curiously, whilst inflation fears were somewhat reflected in shorter bond rates (3yr bonds spiked from 0.6% to 1.3%) the 10yr bond rate rose only modestly from 1.5% to 1.9% and, across the board, interest rates remain at, historically, very low levels.

Month in Review Not much pain was spared so we’ll start with the worst performers first: Zoom2U (Z2U -27%) – the recently listed courier delivery platform and logistics software provider reported solid numbers during the month (2Q22 revenue of $1.3m up 33% on pcp, cash of $6.5m) along with the signing of new customers including Australia Post, Cleanaway and Middys. Whilst the stock is still trading ~50% above its September 2021 issue price, the month-to-month price volatility is endemic for microcaps such as Z2U. And whilst the price movement was disappointing this month, we remain very confident in its future growth given both the structural tailwinds supporting domestic delivery services and the company’s solid operating results since listing. Birddog (BDT -33%) – this professional video technology company listed just prior to Christmas and initially held a 10% premium to issue price before succumbing to selling pressure in the new year. BDT also reported some strong sales results (1H22 sales $24.5m +15%) but has had to spend additional funds up front to secure inventory (due to well documented technology supply chain issues) for its sales pipeline which is the probable reason for the slide in the share price, along with general market malaise. Raiz (RZI -18%) – appeared to be a casualty of the market’s slide and, potentially, sustained some collateral damage from the sentiment shift against the traditional asset managers (note recent falls in Magellan, Pinnacle, Platinum, VGI, GQG and Janus Henderson). However, RZI has experienced continued growth in customer numbers (both domestically and overseas), ongoing fund inflows, and recently reported a modest 2.7% decline in its FUM in January. This result for January is a testament to its customer loyalty, fund inflows and its diversified and conservative investment offerings in the face of a global market sell-off. It wasn’t all bad new however. Boutique craft beer and spirits company Mighty Craft (MCL +17%) benefitted significantly from both customers returning to hospitality post Covid restrictions easing and the amazingly successful launch of a zero-carb, no sugar beer, called Better Beer of which they now expect to sell 4m litres in FY22. MCL reported sales of almost $18m in the quarter, up 50% on the prior quarter. Maggie Beer (MBH +7%) pushed higher again this month. Whilst no further news was released the company’s trading update on 9 November noted Q122 sales growth of 24% (pro-forma) and online sales comprising 44% of all sales which will have likely helped re-rate the stock over the past quarter. Click here for a PDF of this newsletter Media Dean Fergie featured in several pieces for the Livewire 2022 Outlook series including:

Outlook Somewhat counterintuitively, it’s reasonable to feel upbeat after a significant (and swift) market slide. The market, over the past few years, has characteristically proven itself remarkably resilient in the face of pullbacks, with it historically posting significant gains in the months post a substantial retracement. Additionally, with respect to the Fund, the declines have not been as a result of negative stock specific news. If anything, the news out over the course of January confirmed the positive performance of many of our holdings. Stocks such as Alcidion (ALC), Corum (COO), Field Solutions (FSG), Mighty Craft (MCL), Playside Studios (PLY), Pure Profile (PPL) and Zoom2U (Z2U) all provided operating updates in line with, or ahead of, our positive expectations. At the time of writing this has resulted in the rebound in many prices in February, equating to more than 4% in positive performance in the early part of the new month. Of course, the market is a fast moving beast but, with an eye on the long-term, we feel confident that the Fund is positioned to provide decent capital growth in the near-term.

Cyan Investment Management AFSL No. 453209 An investment in the Cyan C3G Fund can be made by clicking here |