12 Nov 2021

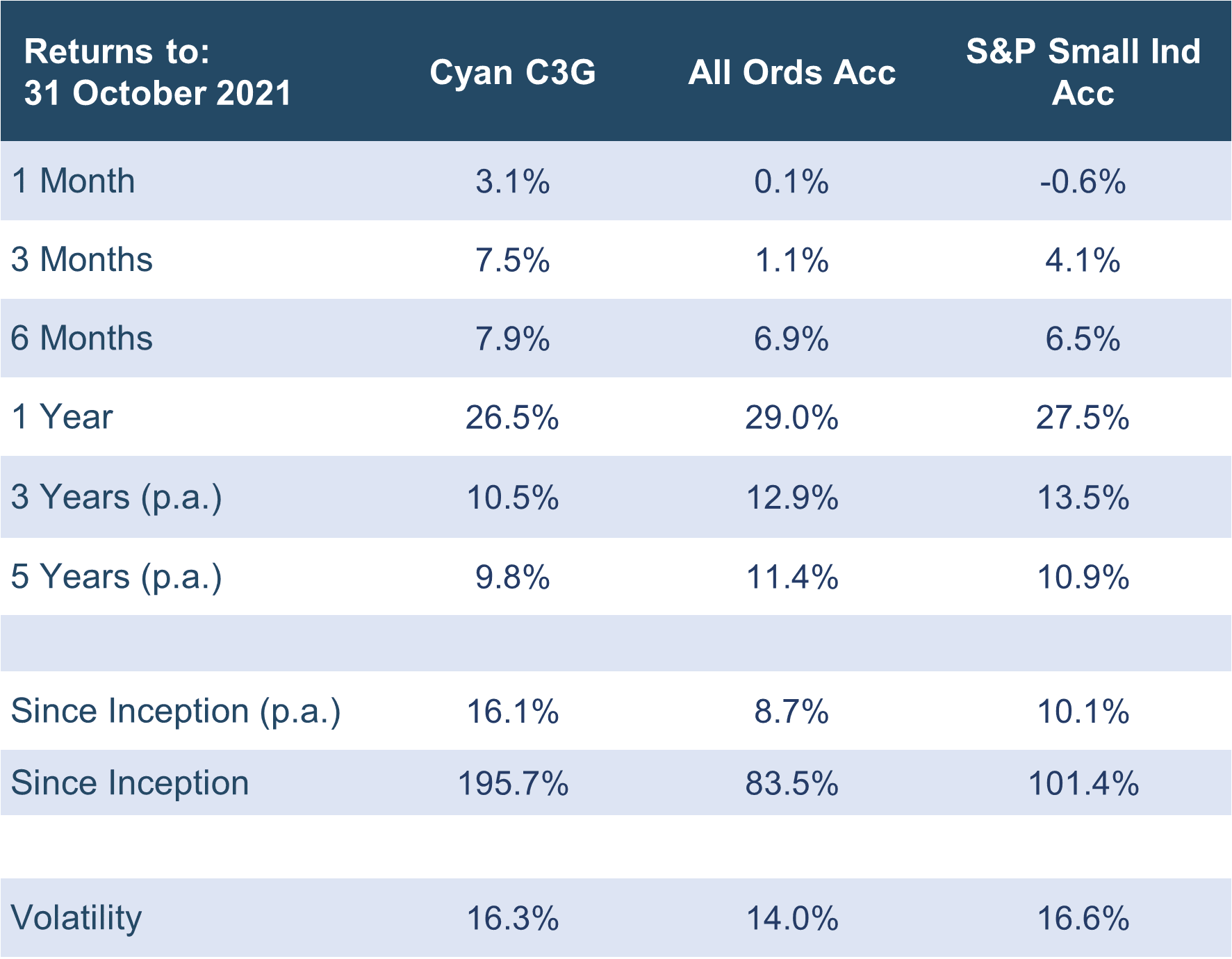

Click here for a PDF of this newsletter The Cyan C3G Fund delivered a strong result over October with a return of +3.1%, led by a mix of long-term core portfolio holdings and bolstered by some recently added positions. The broader Australian market struggled to find momentum through the month (All Ords Accumulation +0.1%) as speculation around inflation, government response, the yield curve and its potential impact on equities continued to impact any positive sentiment.

That said, corporate opportunities remain in abundance in the pre-IPO, IPO and, increasingly, in the secondary market, as companies look for capital to drive growth, both organically and through acquisition. As such, we have taken profits in some existing holdings such as City Chic (CCX) that now look fully valued to direct funds to upcoming opportunities. For example, we invested in an emerging video technology company Birddog on a pre-IPO basis earlier this year and will increase this holding in the imminent IPO round. The company is expected to list pre-Christmas and we believe it has a strong growth story that should be embraced by the investment community. Click here for a PDF of this newsletter We had some strong performances within the portfolio through the month:

There were only a few companies that detracted from performance in the month, most notably Touch Ventures (TVL: -21%) which has continued to see its share price decline post its September IPO. The company announced a new investment in fintech Till Investments and we expect the news of additional capital deployments to continue. Corum Group (COO: -7%) and Kip McGrath (KME: -7%) also drifted slightly but without any corresponding negative news.

Media Cyan featured in Ausbiz again during the month – all of our Ausbiz appearances are listed here. All details are in the ‘News’ section of our website. Outlook To reiterate some of our key philosophies which underpin the investment process: We avoid high risk-sectors including Resources and Biotechnology. We are focused on the strong use of capital to provide growth, avoiding high-risk companies burning material cash. We are wary of current aggressive valuations within certain pockets of the market. Typical industry sectors of focus include financial services, technology, education, consumer services and specialty retail, medical services and niche food and beverages. Our investment journey in a business is often initiated through pre-IPO, IPO and secondary market raisings whereby capital is being put to use to grow an already validated product, business model or strategy. In terms of short-term opportunities, we believe a number of the existing portfolio of companies have key catalysts in terms of contract wins or strong underlying business momentum. This should be complemented by some upcoming IPO listings before the end of the calendar year, which we look forward to discussing in coming months. As always, we welcome investors to contact us directly with any queries. Dean Fergie and Graeme Carson |