10 Sep 2021

Click here for a PDF of this newsletter

The ASX All Ordinaries Accumulation continued to push higher in August to finish at a record high, up 2.6%. The Cyan C3G Fund managed to edge higher by 0.8% with the Fund held back somewhat by its conservative cash balance of ~20% and the Fund’s investments in unlisted holdings that have not, as yet, been revalued upwards.

The hectic reporting season was the feature of the month and, by and large, results were ahead of expectations. Certainly the Cyan C3G Fund did not have any major negative shocks. The highlight in the broader market was probably the cash that has been spun off in the way of dividends by the major resources companies due to the short-term spike in iron ore and other commodities, with most commentators expecting this cash to flow back into the market. Without doubt, the capital markets have remained frenetic with capital raisings a daily occurrence.

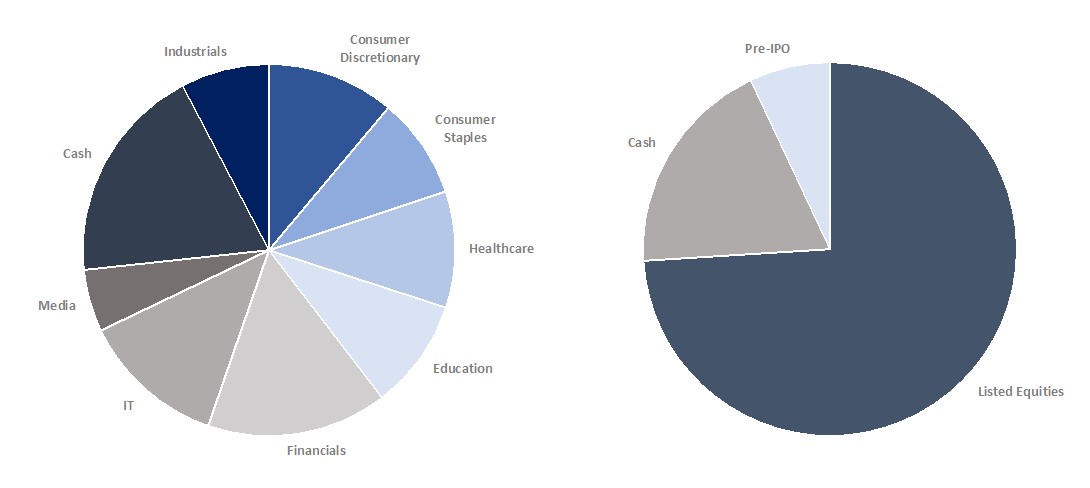

The charts below show our current portfolio composition by industry sector and investment type:

Click here for a PDF of this newsletter

Month in review

Overall we had some pleasing results reports announced over the reporting season.

City Chic (CCX +15%) – had a great year with its women’s apparel sales rising 33% to over $250m and online sales up 73%, resulting in NPAT of $25m, up 81%. The company successfully entered the UK market through its acquisitions of Evans and, post 30 June 2021, its acquisition of eCommerce platform Navabi to enter Europe. It looks to be successfully transitioning its business from an Australian focussed bricks and mortar retailer into a very scalable international ecommerce provider.

Raiz (RZI +18%) – continued its strong organic momentum with increasing FUM, active customers and surging revenue of $13.4m (+37%) in FY21. RZI is presently ahead of its target to reach $1bn in FUM by the end of CY21 but has been somewhat troubled recently by a – we think embarrassing and unnecessary – shareholder spat between the founder and some of the board. RZI was written up in Livewire Markets.

Corum Group (COO +5%) provides point-of-sale dispensing and pharmacy management software to the industry along with a product ordering and invoicing platform through its wholly owned PharmX business. COO’s strong foothold in the industry, growing revenues (FY21 $13.8m +40%), profitability and a market cap of less than $50m means it’s one of our most promising emerging investments.

We also enjoyed gains in Maggie Beer (MBH +5%) and Universal Biosensors (UBI +10%).

In terms of the disappointing results:

Mighty Craft (MCL -15%) has come under reasonable operational and sharemarket pressure due to the extensive lockdowns in VIC and NSW which have severely impacted its venue businesses. To recap the business model, MCL is craft-brewer, spirits and venue company that recently acquired The Adelaide Hills Group. The company owns brands such as Jetty Road, Ballistic and Mismatch Brewers, Kangaroo Island Gin, 78 Whisky and over a dozen associated venues in NSW, VIC and SA. As vaccination rates roll forward it would appear likely that a gradual reopening will occur in the coming months which should see a rebound in the company’s operations and its share price.

Vita Group (VTG – 10%) reported great numbers from its growing beauty clinic division (Artisan) which saw revenue and gross profit rise over 40%. However the market has been awaiting an outcome regarding the acquisition of its portfolio of Telstra stores by Telstra which has yet to be fully negotiated. In the meantime VTG is spinning off cash to its shareholders, paying an interim dividend yielding 2.7% fully franked.

The fund also experienced small slides in the prices of Kip McGrath Education (KME – 4%), Quickstep (QHL – 9%), Readcloud (RCL – 8%) and Playside Studios (PLY -6%).

Over the month we exited our position in Kelly Partners Group (KPG). KPG has had a strong run in its share price this calendar year (+65%) but we are unconvinced that either the modest historical or prospective growth of the business is justified at the current multiples at which the stock is trading.

Outlook

We believe we have a lot to look forward to in the coming weeks.

Our pre-IPO investment in courier technology platform, Zoom2U (Z2U) is due to list on the 10th September. Z2U is an app based, gig economy, courier service (basically like Uber for parcels) that boasts the likes of DHL, Nespresso and Pact group as corporate clients along with 18,000 active SME clients. The company reported almost $12m in GMV last financial year and has raised $8m for business expansion in the IPO. Z2U is also rolling out its own DIY saas platform called Locate2U for small businesses running their own fleets. The strong demand for the IPO, the attractive relative valuation (Z2U has a mkt cap at IPO of $34m) and the recent challenges of Australia Post to keep ahead of delivery demand during lockdowns (Australia Post,will pause parcel pick-ups) suggest a strong debut.

Our other pre-IPO investment that is timetabled to list in the coming month is Touch Ventures (TVL) – the venture capital company backed by Afterpay (APT) (32%) – which has just raised $100m through Bell Potter. TVL has 5 investee businesses including BNPL companies in the UAE (Postpay) and China (Happay). Most significantly, TVL invested US$25m into Australia Post competitor Sendle which has made significant inroads in Australia and is looking to expand into the US. Given the huge investor support of Afterpay – additionally so after its deal with Square that sent the APT’s shares 30% higher – another good debut on listing could be expected.

Additionally we are expecting further good news including contract wins and business expansions from our existing holdings including Alcidion, Corum, Maggie Beer and Playside.

As always, we welcome investors to contact us directly with any queries.