11 Aug 2021

| Click here for a PDF of this newsletter

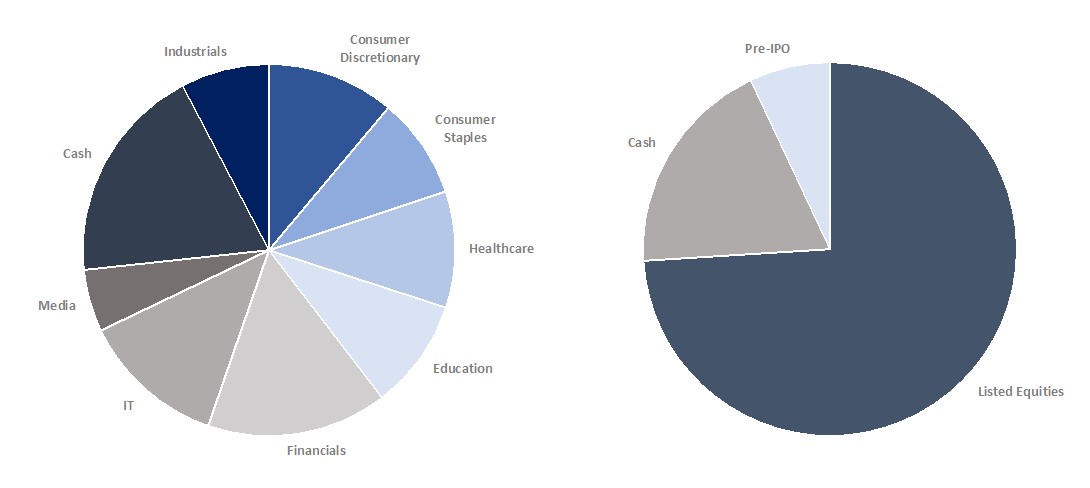

The Fund posted a positive result of +1.8% in April, ahead of both the All Ords and the Small Ords for the month. The Australian market gradually crept higher over the month as investors continue to enjoy a low interest rate environment. Fears over near-term inflation and associated central bank activity abated slightly as the Covid Delta variant took hold, denting confidence around an accelerated economic recovery. The debate around growth versus value and defensive versus cyclical continues. Most recently the growth and tech sectors have received support on the back of the announcement that Afterpay will be acquired by Square Inc for $39bn. This illustrates that fast-growing fintech businesses such as Square Inc are willing to buy aggressively to improve strategic position as they continue to disrupt traditional industry incumbents. Click here for a PDF of this newsletter Month in review Playside Studios (PLY +40%) – This Melbourne based game developer, which listed in December last year, delivered solid cashflow performance and proved that its business model, which combines work for hire and original IP games development, is performing outstandingly. The company has an exciting 12 months ahead with the upcoming release of several new games including titles based on blockbuster movies Legally Blonde and The Godfather which should contribute to a material uplift in revenues in FY22. We would encourage readers to view Playside’s Q4FY21 business update presentation. Raiz (RZI +10%) – Raiz’s fintech micro-investing platform continues to deliver exceptional growth. It is comfortably on track to exceed FUM of $1bn by the close of 2021, representing a doubling in size over 12 months. It remains one of our most high-conviction positions as we find the company’s consumer product offering very compelling. (www.raizinvest.com.au) Maggie Beer (MBH +6%) – Post the Hampers and Gifts Australia acquisition that was completed in May, the market now appears to be realising the benefits, synergies and strengthened business model of the combined group. Particularly considering the extended periods of domestic lockdown, the online element of their hamper business (www.thehamperemporium.com.au) is looking increasingly attractive. Outlook We believe it to be vitally important to have a well-diversified portfolio in the current market conditions where very distinct pockets within the overall market materially outperform or underperform on short-term shifts in sentiment. We are confident in the outlook for the overall equities market over the next one to two years, but mindful there may be periods of increased volatility. We are invested in growth companies at various stages of their lifecycle and within varying industries. We also currently hold around 19% of our capital in cash to be able to move quickly on opportunities, both in the primary and secondary markets which have remained incredibly active. We also have a small allocation in pre-IPO investments which, in all cases, we are confident about material valuation uplifts on listing in the coming months. The charts below show our current portfolio composition by industry sector and investment type:

As always, we welcome investors to contact us directly with any queries. Dean Fergie and Graeme Carson

Cyan Investment Management AFSL No. 453209 An investment in the Cyan C3G Fund can be made by clicking here |