15 May 2020

| After some challenging months, we are pleased to report that the Cyan C3G Fund delivered a return of +9.0% in April. That said, markets remain quite volatile, although certainly not to the extent of that experienced in March. Pleasingly, to date this month, the C3G Fund has traded well into positive territory. We expect this volatility to continue for the foreseeable future as the focus of investors shifts from the direct short-term impact of the virus to the breadth and depth of the economic impact and subsequent changes in commodity prices, government support, consumer behaviour and company profitability (or lack thereof). Month in Review The Fund was particularly active in February and March as the spread and impact of Covid-19 emerged. During that period we repositioned the Fund around a fourfold strategy:

Of those that reported to the market, the underlying trading performance was solid in April, with our relatively defensively positioned portfolio still capturing upside. The best performing stocks included Vita Group (VTG) +69%, Carbonxt Group (CG1) +56%, Raiz (RZI) +46%, Quickfee (QFE) +39% and Jumbo Interactive (JIN) +23%. Only 3 positions delivered minor negative returns with none of them being material detractors to performance. Although we were less active from a trading perspective, we continued to capitalise on opportunities, deploying further cash to the point where the proportion of cash held is now ~25% of invested capital. This was done by increasing some existing positions and adding 5 new companies to the Fund. We increased holdings in a number of smaller existing investee companies including Quickfee (QFE), Carbonxt (CG1) and Schrole (SCL) as well as taking new positions in Kip McGrath (KME), Citadel (CGL), Pinnacle Investments (PNI) and Rhipe (RHP). Media The impeccable Chris Gosselin of Australian Fund Monitors spoke with Dean Fergie about the current market conditions and how the investment team are navigating the Cyan C3G Fund through this tumultuous period. View the video here. Outlook As the dust clears on the direct health impact of the virus, the focus will increasingly shift to the economic impact and stock specific fundamentals. Whilst many companies face serious challenges through the current crisis (as has been evidenced by the struggles of former market stalwarts like the big banks, real estate trusts and infrastructure investments), there are also a number that will be fortuitist beneficiaries. A large proportion of our investments will prosper from what may become a genuine structural change as a result of COVID-19. For example, those exposed to the digitization and online acceleration of education services and associated industries including Readcloud (RCL), Open Learning (OLL), Schrole (SCL) and Kip McGrath (KME). There are also those exposed to industries that have enjoyed strong demand for their products or services including JB Hi-Fi (JBH), Rhipe (RHP), Service Stream (SSM), Citadel (CGL) and Quickfee (QFE). As the economic and financial impact of the current crisis materialises in the coming months, we are of the view that this cohort of companies will have displayed much stronger earnings resilience and cashflow generation, which has a two-fold benefit:

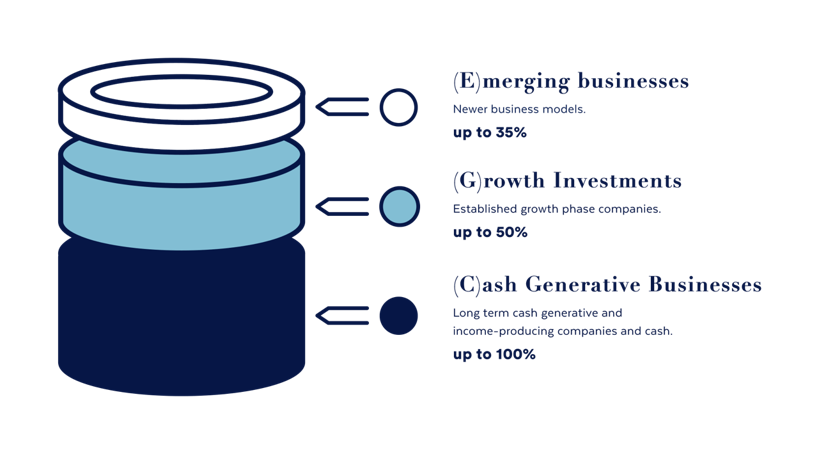

We believe we have positioned the portfolio to traverse what will continue to be challenging terrain in the coming months. We thought it worthwhile to illustrate how we construct the Fund to find a balance between risk and return.

The diagram above shows the 3 structural components of the Cyan C3G Fund which typically represent the lifecycle stage of the business and usually also the size, profitability, cash generation and risk profile:

Whilst the current uncertainty is likely to remain for some time, we believe the Fund is well diversified and exposed to fundamentally strong businesses that offer material upside over time. We would hope that over the next 2 to 3 years a number of our “Emerging” and “Growth” companies will grow to become “Cashflow” investments, and the capital from some of our existing “C” investments will be redeployed into newly discovered “E” and “G” opportunities. If you have any questions about the Fund, our current exposures or investment philosophy and strategy, as always, we are contactable in person.

|