08 Oct 2019

The C3G Fund enjoyed an exceptional month, delivering +8.6% (after all fees), strongly outperforming the broader market with the All Ords and Small Industrials up 2.1% and 3.3% respectively. Calendar 2019 has been an outstanding year for the Fund with it having returned more than 30% to unitholders in the past 9 months.

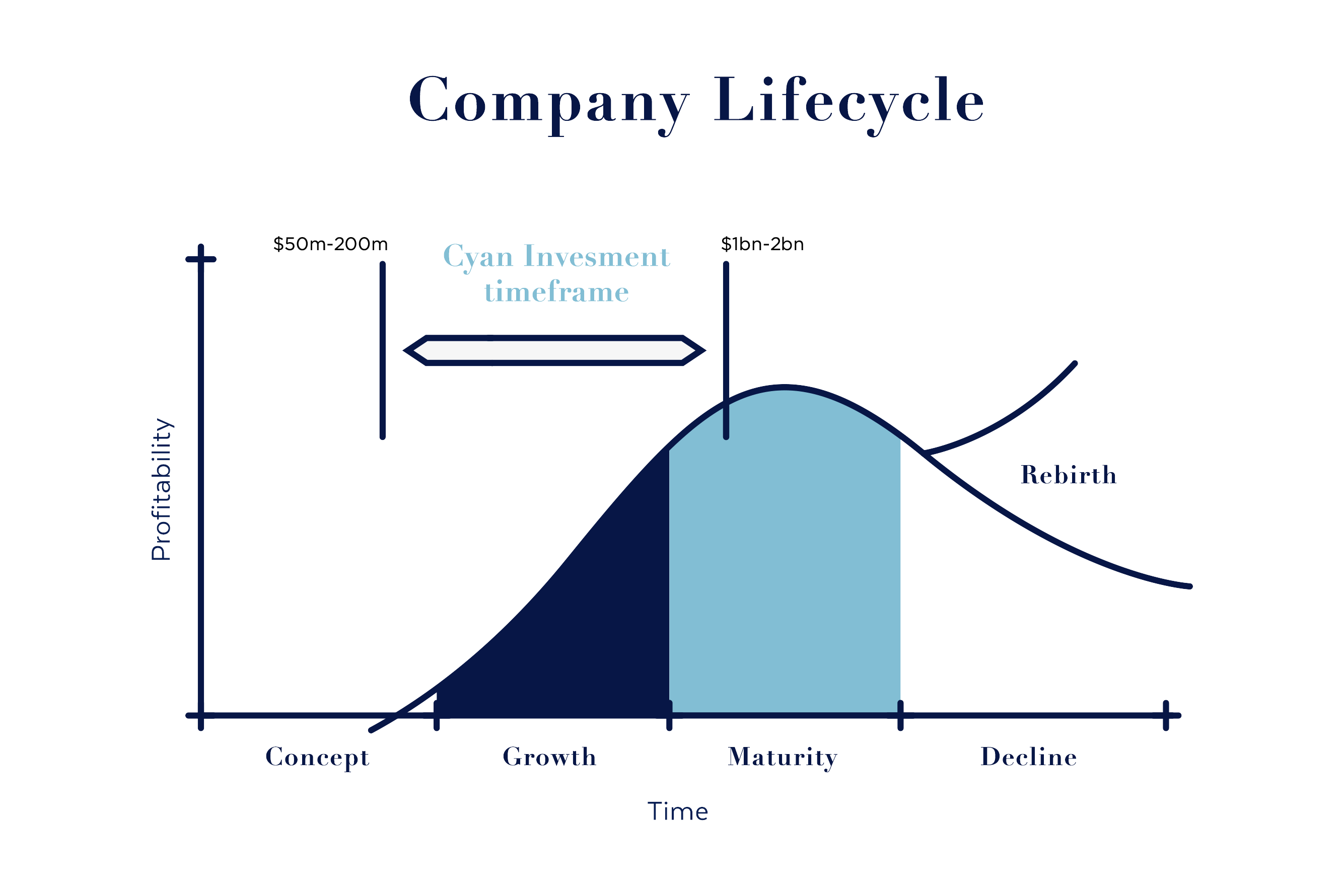

At Cyan, our primary focus is to deliver growth to our investors, whilst carefully managing risk. To do so, we invest in companies at various points of maturity and we prudently weight those companies in the Fund according to our analysis of the underlying risks versus the potential investment returns.

This typically results in a portfolio of 25 to 35 companies ranging in market capitalisation from $50m to $1bn and with Fund weightings usually between 1.5% and 7% of the total Fund value (with a hard maximum of 10%). The diagram illustrates where we like to invest in respect to size and lifecycle stage of a company.

September was a month in which the portfolio enjoyed great returns from some of our bigger companies but, pleasingly, also saw a number of our earlier stage companies deliver catalysts that proved they are executing their growth strategies and beginning to move up the profitability curve.

Month in Review

Obviously during such a strong month there were numerous positive contributors in the Fund and few detractors. In fact, 7 of our holdings rose more than 30% over the course of the month and another 6 delivered impressive double-digit percentage gains. Some of the top contributors that are displaying the characteristics of growing from infancy towards maturity are:

Alcidion (ALC) +65%: This health-tech business has been a superb performer for the Fund with its price having increased more than 600% since our initial investment 6 months ago. As the price action has been spectacular we have realised some capital gains along the way but also remain invested due to the significant opportunity to grow this scalable software business both domestically and offshore.

Oventus (OVN) +49%: This medical device business (a recent addition to the Fund) operates in the sleep apnoea space and is beginning to gain traction in its US market expansion. After a couple of false starts where OVN struggled to find the correct distribution model, investors are now confident that its strategy (distributing their products through dental clinics) will deliver material growth in North America, which prompted our investment. We expect the recent positive news flow to continue in the coming months.

Quickstep (QHL) +44%: We have discussed QHL previously, but this advanced manufacturer of high-value carbon-fibre products continues to make great progress in driving its existing operations and it was rewarding to see the company reported its maiden profit in FY19. The broader market is beginning to take notice and new institutional investors are appearing on the share register. In FY20 we forecast both organic and new contract revenue growth combined with margin expansion to drive further earnings growth.

Quickfee (QFE) +31%: As a relatively recent IPO, the price action in QFE has followed a well-worn path by listing at a strong premium before settling back and then accelerating again. The business offers premium funding and payment solutions to the accounting and legal industries in both Australia and the United States, with both regions displaying solid growth numbers. QFE is still in the early stages of its company lifecycle but the most recent company update displayed excellent growth in the US with lending up 77% in the past year.

Outlook

External factors such as global political uncertainty and trade wars will continue to cause bursts of volatility in equity markets. But with official RBA interest rates recently being cut to just 0.75%, we thought it timely to consider the return of income investments versus our Fund. Of course, the risk profile of these investments are significantly different – most income investments have little if any capital risk, our Fund does carry the risk of capital loss.

With current term deposit rates sitting at around 1.3% p.a., for an investor to achieve the same financial outcome that the Cyan C3G Fund achieved in just the September quarter, their funds would need to be invested in a term deposit for more than 10 years. Further, with 10yr Australian Government Bonds presently yielding just 0.89%, even that time frame is optimistic.

Thus, with historically low interest rates, investors are simply not being rewarded for conservative investment decisions. As such, we believe, investors with excess capital should be carefully considering their current asset allocation choices. The market may be trading at a slight premium to long term averages in terms of price to earnings ratios, but low interest rates support company valuations and we continue to see what we consider to be some excellent investment opportunities at the smaller end of the market.

We thank all our investors for their support and look forward to keeping you all updated with the Fund’s progress.