13 Dec 2018

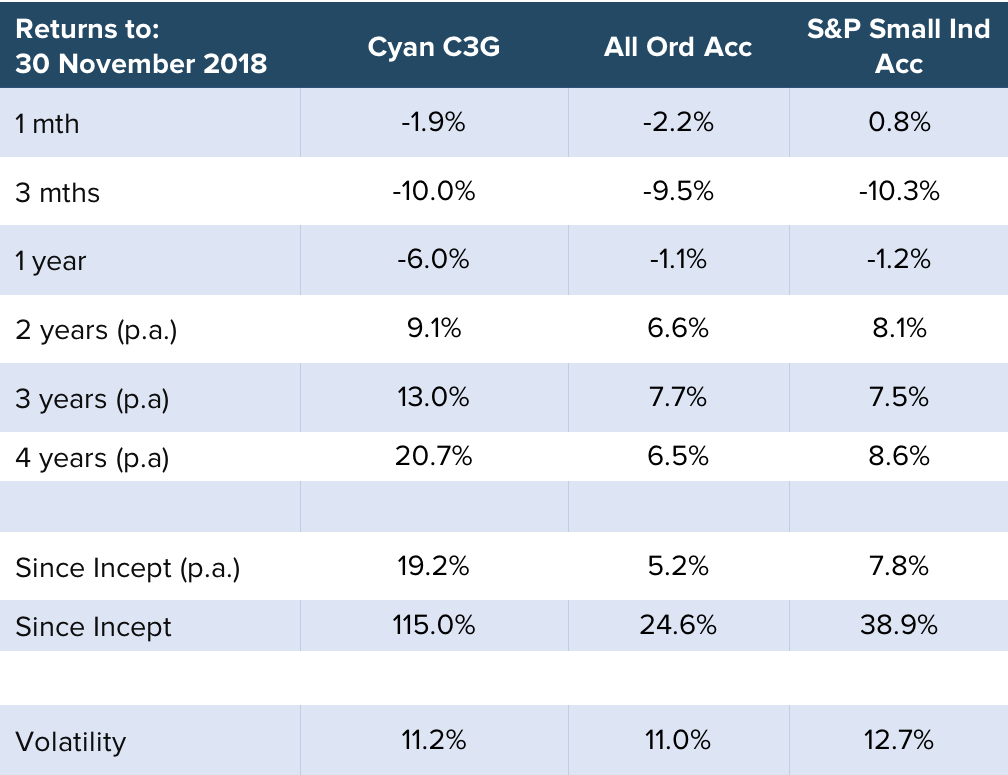

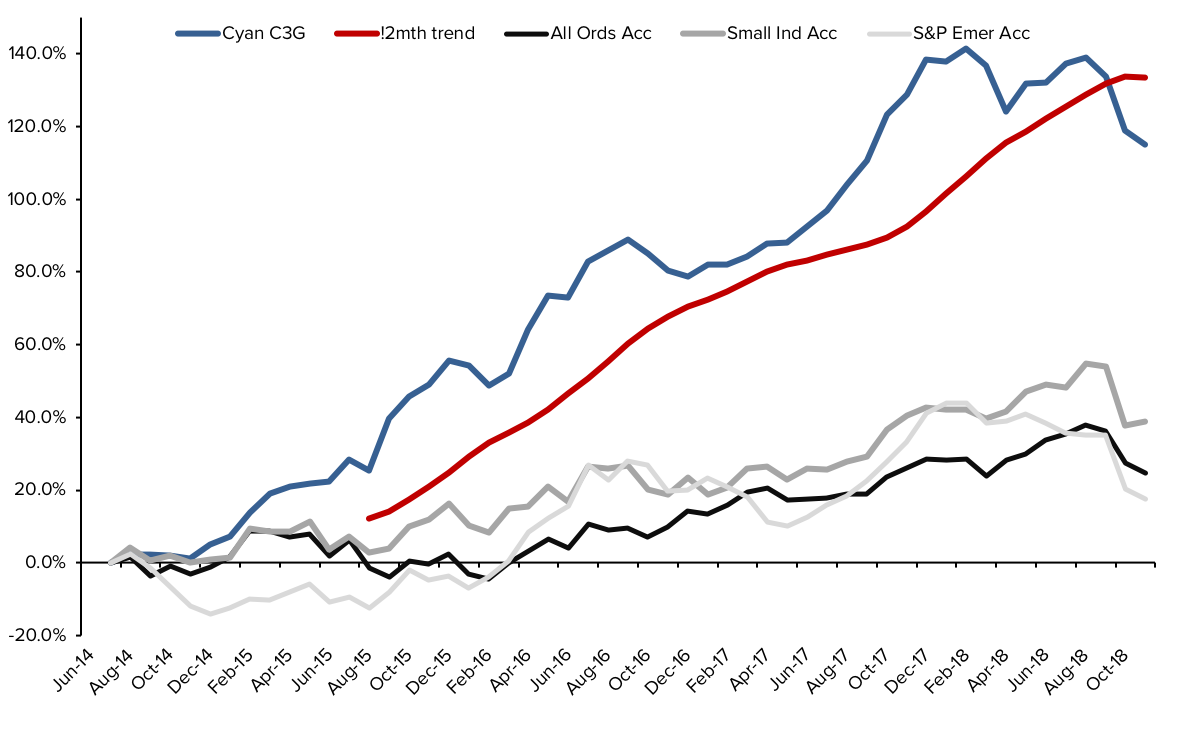

The difficult market conditions continued to drag on the performance of the C3G Fund which saw it retrace 1.9% in November, a slightly better performance than 2.2% fall in the ASX All Ordinaries. Despite the challenging backdrop of calendar 2018, thanks to gains made in more favourable markets, the Cyan C3G Fund continues to post solid longer term annualised returns of 13% p.a. over 3 years and almost 20% p.a. since inception in 2014. |

November Review As the press has vigorously reported, it’s been an extremely difficult market in which to post gains, with the overall market having fallen almost 10% since its peak in August. As at last month, the C3G Fund has remained well diversified with 24 positions and no individual holding representing more than 5% of the total Fund. The Fund has also retained slightly more cash than it did last month which has helped in the bearish environment. Nevertheless picking a cohort of positions that are rising in this market has been like the finding proverbial needle in a haystack. Some of the notable moves this month: Pivotal Systems (PVS) – a semiconductor company that we visited in the US back in August, had been a remarkably successful IPO, having gained more than 50% since its ASX listing in July. Disappointingly, the company reported (just 6 days after confirming to us that all was on track) that delays to its orders would result in it missing prospectus forecasts. PVS was down 20% in November and, having no time for under-achievers. we exited the small position we held. Motorcycle Holdings (MTO) – down 27% for the month. The pullback in domestic new vehicles sales has been severe, with y.o.y. falls in excess than 5%, the worst decline since 2011. Motorcycle sales are traditionally much more volatile hence the downward pressure on the MTO share price. Whilst this pain is acute, any signs of life in the sector are likely to see a decent re-rating, particularly in light of the bottom-of-the-cycle 10x PE multiple on which the stock currently finds itself. Afterpay (APT) rose 15% in November (after falling 30% in October) helping to negate some of the negative performers. APT has been whipped around by continued talk (and concern) of regulatory oversight of the ‘Buy Now, Pay Later’ sector. However an ASIC report released late in the month should allay these fears. We attended APT’s AGM at the end of the month which confirmed their extensive progress toward building a significant business in the US. Whilst the stock can be expected to remain volatile, we remain extremely confident that the inherent value in this high-growth company will be notable greater this time next year, particularly due to the customer and merchant traction being gained both here and overseas. Experience Co (EXP) gained 16%, albeit off quite a low base. EXP is one of a handful of companies that we have been actively adding to recently and we we suspected the bounce would occur once a wave of institutional selling was completed. Like Afterpay, EXP’s AGM during the month reiterated their solid performance to date this financial year and we fully expect reasonable gains to be seen over the next year, given the pressure the shares have been under and the outstanding value they currently appear to offer. Freelancer (FLN) marched a further 30% higher in November despite no new material news being reported. As we wrote last month, FLN’s major, and direct, competitor Upwork https://www.upwork.com/ had a very successful listing on the NASDAQ at the start of October although it did fall during November along with more of the tech laden NASDAQ market. Despite Upwork being less profitable, it has a market capitalization of US$1.8b versus FLN’s now AU$400m which clearly has sparked interest in the FLN story. Isentia (ISD) – is a new position we added to the Fund in November. We clearly have a shortlist of companies we would like to buy at the right price, and after a fall of 80% this year, we felt the AGM will be the defined turning point for this unloved media intelligence company. Isentia has a new Chairman, Managing Director and CFO and with forecast FY19 revenues of more than $120m and an EBITDA expected to be above $20m, a market capitalisation of less than $60m appears an incredibly attractive entry point.

Especially at the smaller end of the market, it’s been incredibly difficult for us to ‘find a break’. Even the companies that have reported solid performances during the AGM season (PSC Insurance, Kelly Group, Experience Co., Afterpay) have struggled to find sustained buying support. Of course one must take the good with the bad and 2017 was a brilliant year to have been invested. Certainly we have done the right thing in ‘cashing up’ toward the beginning of 2018 however we have still felt more pain than we would have hoped. With myself and Graeme Carson having worked in the markets combined for more than half a century (a scary thought in itself!) we know better than to ‘throw the baby out with the bathwater’ when the markets looks a little shaky. We have never professed to be able to pick the top (or the bottom) of any marketplace and believe it foolish to attempt do so. Long-only investing means cautiously enjoying the good times (knowing full-well they will not continue indefinitely), and shrewdly navigating the bad times, equally aware of both the risks and the opportunities. Without doubt, investing in a bear market is not easy, nor fun, nor profitable. But we know that these are the times when we have the opportunity and the ability to prudently position the Fund to benefit from any upturn. Just as bull markets do not last forever, neither do bear markets. Often the best time to invest, is when most other are considering doing the exact opposite. As always we are contactable in person and encourage you to do so, particularly through the present market conditions. Dean Fergie and Graeme Carson Cyan Investment Management AFSL No. 453209 |