13 Jul 2018

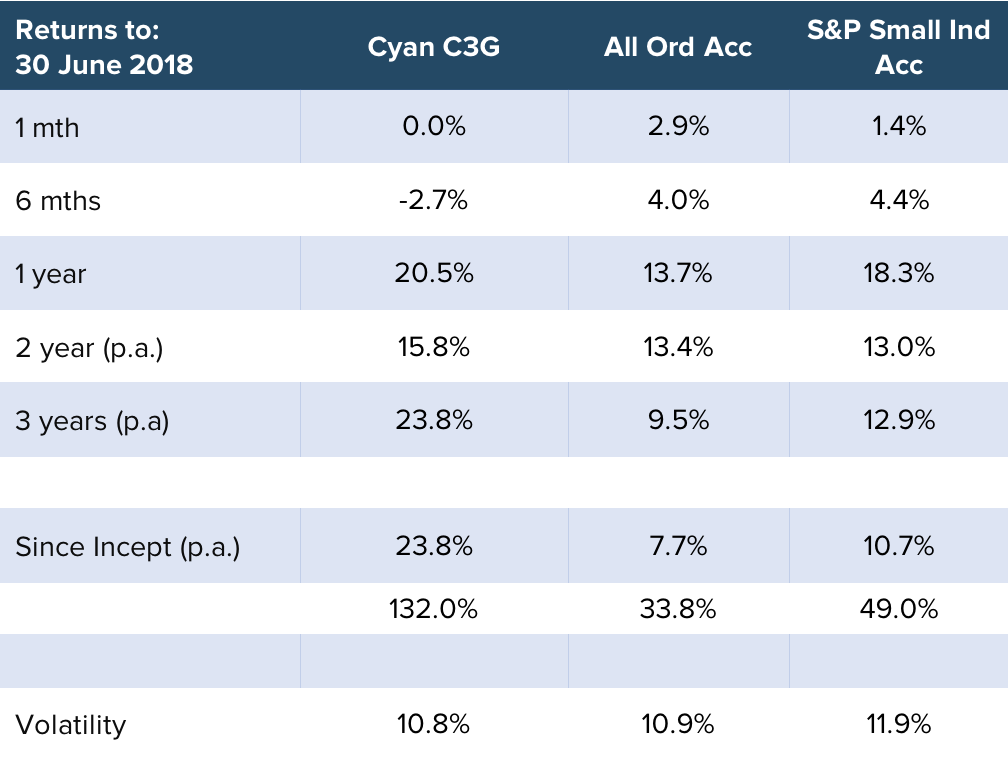

Whilst the Cyan C3G Fund posted a flat result for the month of June 2018 and a return of -2.0% for the past 6 months, the very strong start to the period resulted in return of 20.5% for the 2018 financial year.

The 12 month return was ahead of all comparable indices and, because of our selective investment focus, strong risk management framework and, at times, conservative cash balances, was delivered with lower investment volatility for our clients.

The Fund is now approaching its 4 year anniversary (at 31 July 2018) and is forecast to show an annualised return to clients (after all fees) of more than 23% p.a.

Whilst the overall market pushed higher due to the performances of some of the major ASX stocks (such as the rebound across the banking sector and rises in the larger resources such as BHP and Woodside) the very small end struggled with the Emerging Companies Index falling 1.7%.

The flat result for the Fund this month belied some underlying stock volatility as noted below:

Readcloud (RCL +24%): Whilst not reporting any financial numbers in June, RCL released an investor presentation that the company delivered to a Thorney conference in Sydney at the end of May which seemed to result in additional buying support.

AfterpayTouch (+20%): Despite its already significant market capitalization of over $2bn, APT marched significantly higher as the company gains traction in its US rollout.

Roots (ROO -23%): Roots has always experienced volatile share price performance since listing due to its relative low liquidity but, even after this month, remains over 50% above its IPO price. The share price performance in June is somewhat confounding given there has been Director buying in the month and ongoing positive announcement about the commercialisation of their agricultural technology.

AxsessToday (AXL -7%): Being the Fund’s largest shareholding, even single digit returns will impact the Fund more significantly than other holdings. AXL was at a record high at 31 May and so the small pullback in June was likely the result of some profit taking. The business remains in great shape and we expect it will be a solid performer throughout FY19 and will contribute significantly to overall Fund returns.

FY18 Review

With a return to investors of in excess of 20% after all fees, we have been pleased with the Fund’s overall result in FY18.

As we note publicly, we believe longer-term expectations of 10-15% p.a. are achievable in the Cyan C3G Fund and have been consistently been achieved over its 4 years lifespan. In addition, we believe we can achieve these outcomes by taking less risk than a comparable investment in the overall market.

Of course, Cyan operates in a specific, but highly attractive niche in the Australian market. That being: high-growth, commercially proven, under-acknowledged, largely domestically-based industrial businesses. Importantly, when we cannot find appropriately attractive investment opportunities, we will not invest. Patience is a highly under-rated characteristic when it comes to stock market investing.

Being a niche, and with typically a smaller market capitalisation and hence lower liquidity, stock prices in the sector (in the short-term) can often be whipped around by investor sentiment or larger fund flow. This can create risk but also opportunity. The frustrating aspect is that the timing can often be impossible to predict and hence we implore investors with us to look towards a longer-term timeframe.

What we know from experience is that if the correct investments are chosen, they will deliver exceptional returns over the longer-term, despite short-term gyrations.

In respect to the holdings held for the financial year to June 18, we note the following results:

Afterpay Touch: 217%

Moelis Australia: 74%

Axsesstoday: 59%

Psc Insurance: 30%

Capitol Health: 27%

AMA Group: 10%

Opus Group: 7%

Experience Co: 0%

Kelly Partners:-11%

Outlook

The Fund has taken a handful of new investment positions in the past couple of months, deploying a portion of our defensive cash balance. We envisage further investment in the coming quarter as more new opportunities have now been identified. That said, we have also reduced a couple of exposures as they are approaching our valuation target.

Pivotal Systems (PVS) is one of the IPOs we have subscribed to in the past few months. PVS provides gas flow controllers for semiconductor manufacturers such as Intel, Samsung and Hitachi. Pivotal’s attractive market position and growing revenues of US$30m in FY18 up from US$8m in FY16 certainly provide an attractive entry point and we expect there will be a pipeline of positive news flow. PVS listed on 2 July 2018 at a 40% premium to its issue price.

We thank our investors for your support and look forward to another successful financial year.

Dean Fergie & Graeme Carson