12 Mar 2018

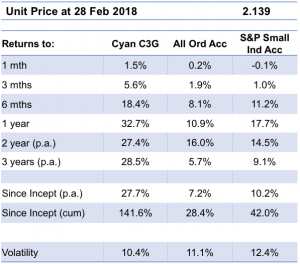

Despite the volatile backdrop the Cyan C3G Fund delivered a +1.6% return in February 2018 (after all fees) taking the 12 month return to 32.7%.

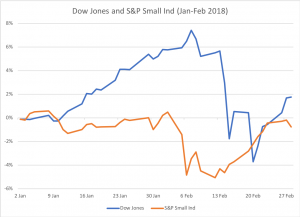

Global markets certainly experienced significant gyrations through February. The market rout caused by a severe and sudden sell-off in the US (the Dow Jones dived 9% in just 5 trading days) was quickly reversed with the Australian market more-or-less ending February square. Certainly during the first half of the month, we were thankful for the Cyan C3G Fund’s defensive cash balance.

The ASX reporting season was one of the the more volatile in recent memory with companies being either rewarded or caned depending on the outcome of their results. Stocks such as A2 Milk, Altium, Kogan and Lovisa all posted impressive results to 31 December and enjoyed price rises of 15% or more. On the downside, a number of ex ‘market darlings’ disappointed including Dominos, BWX, Vocus, Blackmores, Wisetech, G8 Education, Silver Chef, Super Retail, Harvey Norman and Retail Food Group with loyal shareholders licking their 15-30% wounds.

The Fund’s performance has been solid over more than a year with 13 out of 14 months in the black. We can also report that the Fund in March 18 (to date) has enjoyed small overall gains.

Earnings Reports

A snapshot of the Fund holdings over reporting season:

- Spirit Telecom (ST1) +27%: A solid 1H18 result and continued momentum stemming from the troubled NBN roll-out saw further interest in the small residential ISP play. We wrote a more detailed note for Livewire here;

- Axsess Today (AXL) +20%: Despite recent rises, the momentum in equipment financier AXL was sustained by an impressive 1H18 result. (Revenue up 155% to $22m, NPAT up 95% to $3.2m and supported by a 2.9c fully-franked dividend). The potential securitisation program which will reduce funding costs and improve profitability is the next positive catalyst for the business. Late last year we wrote a piece on AXL for Livewire here and posted a video about the stock here;

- Readcload (RCL) https://readcloud.com/ +90%: Readcloud digitises and distributes electronic school textbooks. At the time of listing RCL counted as paying clients 50 schools and more than 20,000 users on its platform. We subscribed to a small amount of stock in the IPO attracted by the revenue generating business and thematic of electronic textbooks. As a parents of high-schoolers we are acutely aware of the archaic nature of physical schoolbooks and believe, if executed well, this company has a bright future.

The month was not without its challenges and there were a handful of positions that did struggle.

- Motorcycle Holdings (MTO) – 12%: The company’s 1H18 numbers were a little light with a fall in insurance and financing revenue and soft sales being offset by recent acquisitions and store roll-outs;

- Experience Co (EXP) -5%: Poor weather in NZ contributed to low processing rates (skydiving jumps vs bookings) although the company’s strategic diversification away from pure skydiving is reducing the company’s overall risk;

- Kelly Partners (KPG) -9%: Whilst the 1H18 result was in-line with expectations, this stock will always get moved around by its low liquidity. Given it is trading 60% above its IPO price we reman long-term shareholders and like the strong thematics. We posted a video on our outlook for KPG here.

Outlook

Again the market has started the new month in a negative frame of mind. With results season past, we’re seeing a number of corporate deals come across our desk and to date have taken a placement in BlueSky (BLA) and subscribed for some shares in a new IPO. During the market weakness there were a number of Fund holdings that we added to including AMA Group (AMA) and Moelis (MOE) and overall these trades have been rewarded.

We currently have just over 20 positions and in excess of 45% of our total capital invested in cash. Even with this controlled portfolio, we’re confident we can provide solid returns to our clients. Recall that with our performance fee hurdle of 10% p.a. (2.5% per quarter) we have a financial incentive to make meaningful gains, yet we wish to do this in a conservative and disciplined manner.

At Cyan we will continue to adhere to our long-held investment philosophies, ride-out the current volatility and make opportunistic investments we deem appropriate within our risk parameters.

Thanks for the support from our investors and we are available to be contacted at any time.

Dean Fergie and Graeme Carson

Cyan Investment Management